UK Inflation Cools While US Sees Uptick as Economic Sentiments Shift

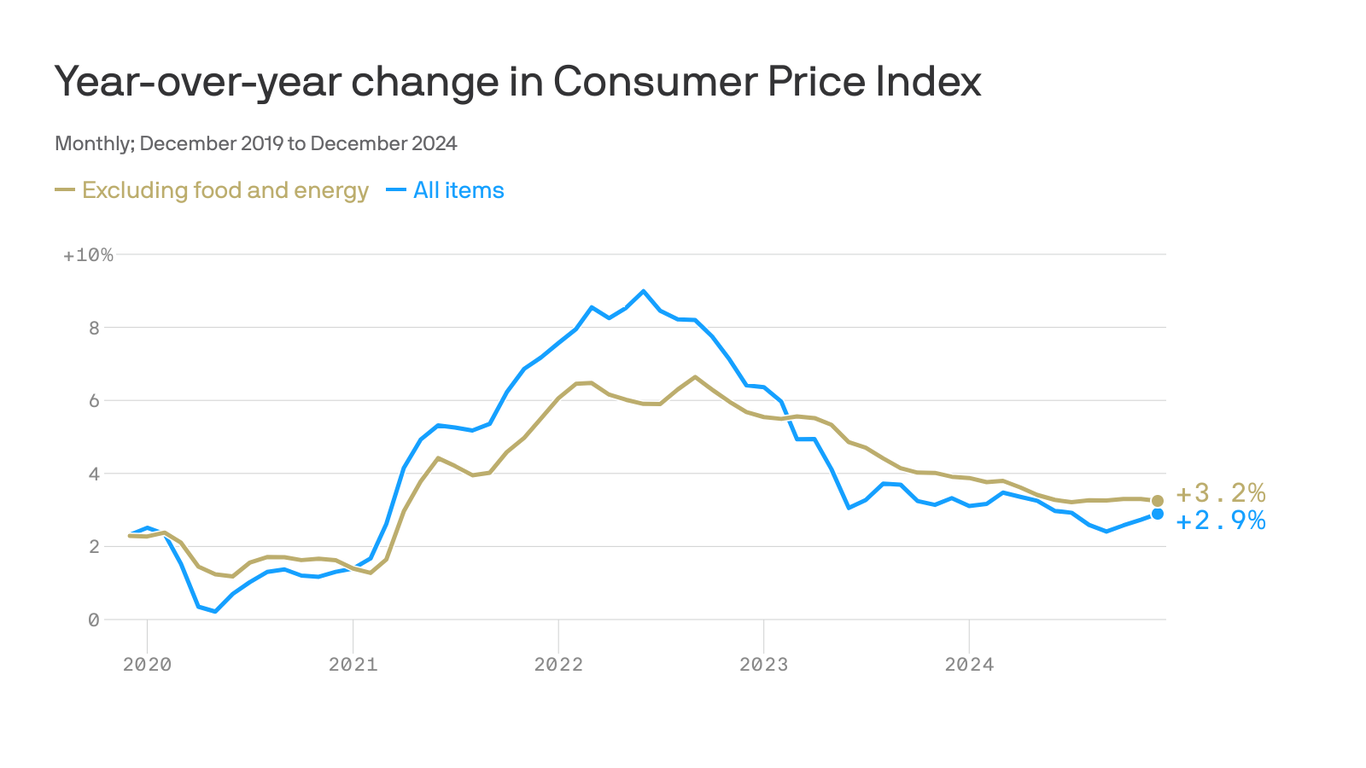

UK inflation drops to 2.5% in December, easing pressure on government; US inflation rises to 2.9%, complicating rate cut forecasts.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

In December, UK inflation dipped to 2.5%, helping reduce government borrowing costs and raising expectations for potential Bank of England rate cuts. Meanwhile, US inflation rose to 2.9%, driven by energy prices. Core inflation in the US held at 3.2%. Concerns over US tariffs under President-elect Trump add uncertainty. Analysts suggest the reduced UK inflation offers the Bank of England more leeway for interest rate adjustments, as UK bond yields fell significantly, providing some relief amid broader global market volatility. The economic outlook remains cautious as rising energy prices could impact future inflation.

Report issue

Read both sides in 5 minutes each day

Analysis

Analysis unavailable for this viewpoint.

Articles (33)

Center (19)

History

- 10M

4 articles

4 articles

- 10M

4 articles

4 articles

- 10M

6 articles

6 articles