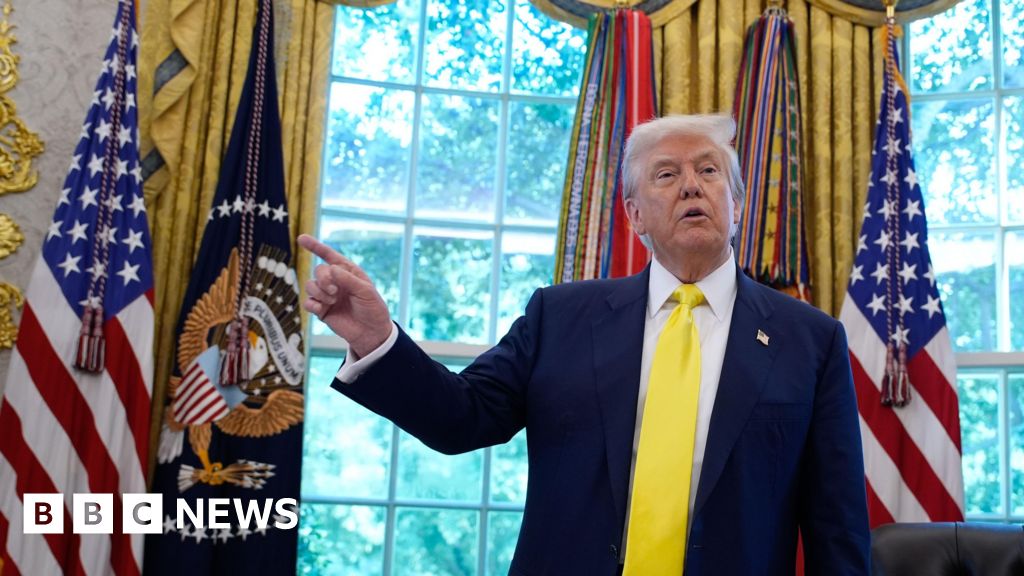

President Trump Plans Executive Order to Allow Alternative Assets in 401(k)s

President Trump plans an executive order to allow alternative assets like private equity and crypto into 401(k) retirement accounts, opening the $12 trillion market.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

- President Trump intends to sign an executive order to permit alternative assets, such as private equity, real estate, and cryptocurrency, within 401(k) retirement accounts.

- The order will direct the Department of Labor, Treasury, and SEC to issue necessary guidance, facilitating access for these new investment options within existing retirement plans.

- This initiative aims to open the substantial $12 trillion defined contribution retirement fund market to major alternative asset managers like Blackstone, KKR, and Apollo.

- Supporters view this development positively, believing it could offer retirement savers new avenues for growth and diversification within their long-term savings plans.

- Conversely, critics express significant concerns that introducing alternative assets into 401(k)s could substantially increase the overall risk profile for millions of retirement savers.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources cover this story neutrally, presenting factual information about Trump's order to expand retirement investment options. They balance the stated intent of increasing access for everyday workers with concerns from critics about potential risks. The reporting provides historical context and industry responses without adopting a particular stance or using loaded language.

Articles (13)

Center (8)

FAQ

The executive order allows alternative assets such as private equity, real estate, and cryptocurrency to be included in 401(k) retirement accounts.

The Department of Labor, the Department of the Treasury, and the Securities and Exchange Commission (SEC) are directed to issue guidance and revise regulations to facilitate access to alternative assets in 401(k) plans.

The initiative could offer retirement savers new investment avenues for growth and diversification, potentially leading to stronger and more financially secure retirement outcomes.

Critics express concerns that allowing alternative assets such as cryptocurrency and private equity could significantly increase the overall risk profile for millions of retirement savers.

It could open the $12 trillion defined contribution retirement fund market to major alternative asset managers like Blackstone, KKR, and Apollo, providing them access to a vast new pool of retirement money.

History

- 3M

5 articles

5 articles

- 3M

4 articles

4 articles