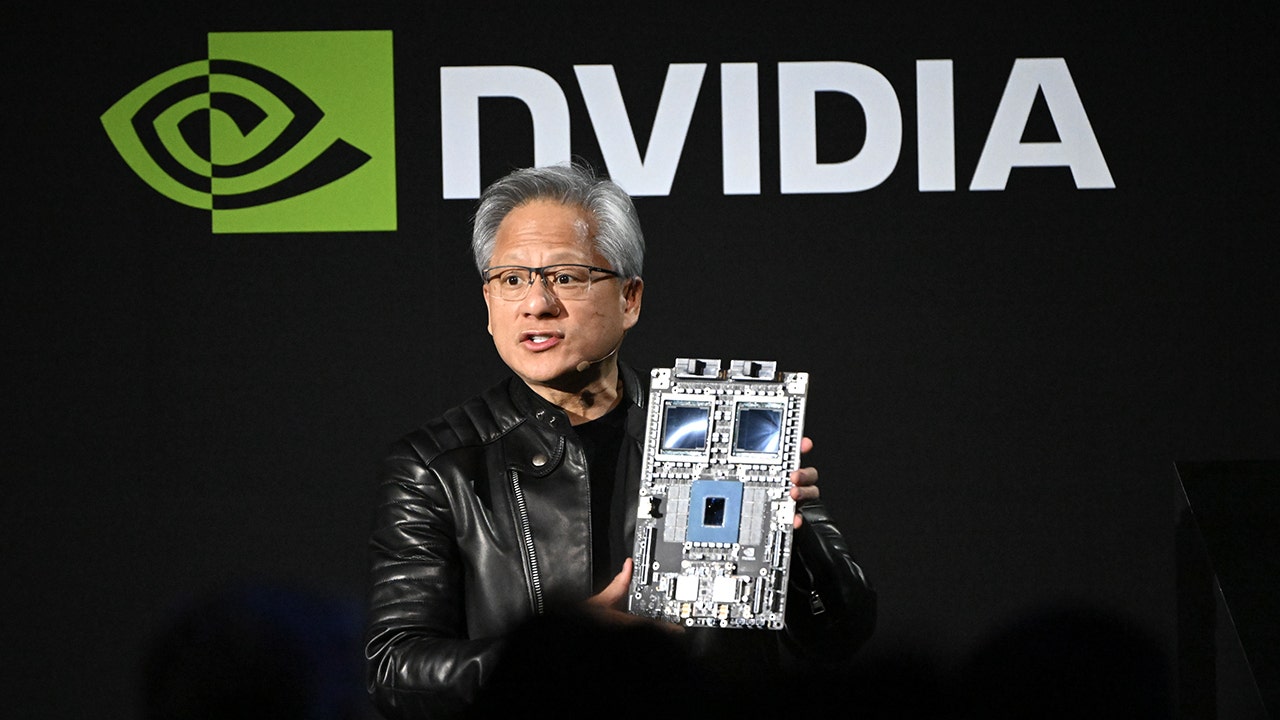

China Rules Nvidia Violated Anti-Monopoly Laws in Mellanox Acquisition

China ruled Nvidia violated anti-monopoly laws over its 2020 Mellanox acquisition, potentially facing fines. This decision escalates US-China trade tensions, impacting Nvidia's business in China.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

- Chinese regulators have officially ruled that U.S. chipmaker Nvidia violated the country's anti-monopoly laws, confirming earlier accusations and investigations into the company's business practices.

- The violation specifically stems from Nvidia's $6.9 billion acquisition of Israeli company Mellanox in 2020, where China alleges the company failed to meet conditions set during the approval process.

- This ruling could result in significant fines for Nvidia, potentially ranging from 1 percent to 10 percent of its previous year's sales, impacting its 13 percent business in China.

- The decision is set against a backdrop of ongoing U.S.-China trade tensions, with China also discouraging firms from purchasing Nvidia's chips to reduce reliance on U.S. technology.

- The allegations and regulatory scrutiny were discussed by U.S. and Chinese officials, including Treasury Secretary Scott Bessent, highlighting the interconnected economic and geopolitical concerns between the nations.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources frame China's antitrust ruling against Nvidia as an escalation in already "strained" U.S.-China trade tensions, particularly concerning semiconductors. They emphasize the ruling's potential to "cast a pall" over negotiations and extensively detail past U.S. restrictions on AI chip exports to China, positioning the event within a broader geopolitical rivalry rather than focusing solely on the antitrust specifics.

Articles (9)

Center (4)

FAQ

China accused Nvidia of violating anti-monopoly laws by failing to comply with conditions imposed during the 2020 approval process for acquiring Mellanox, including undisclosed commitments likely related to national security and customer access to products.

Nvidia could face fines ranging from 1 percent to 10 percent of its previous year's sales, which would significantly impact its business in China, where it generates about 13 percent of its revenue.

The ruling escalates ongoing trade tensions between the U.S. and China, particularly in technology and semiconductors, as China aims to reduce reliance on U.S. technology and has increased scrutiny on U.S. firms like Nvidia during current trade discussions.

Nvidia stated that it complies with all laws and will continue cooperating with relevant government agencies as they review the impact of export controls on competition in commercial markets.

The $6.9 billion acquisition of Mellanox in 2020 expanded Nvidia's capabilities into high-performance networking, complementing its expertise in AI computing and data centers, and significantly accelerated the growth of its networking business.

History

- 2M

3 articles

3 articles