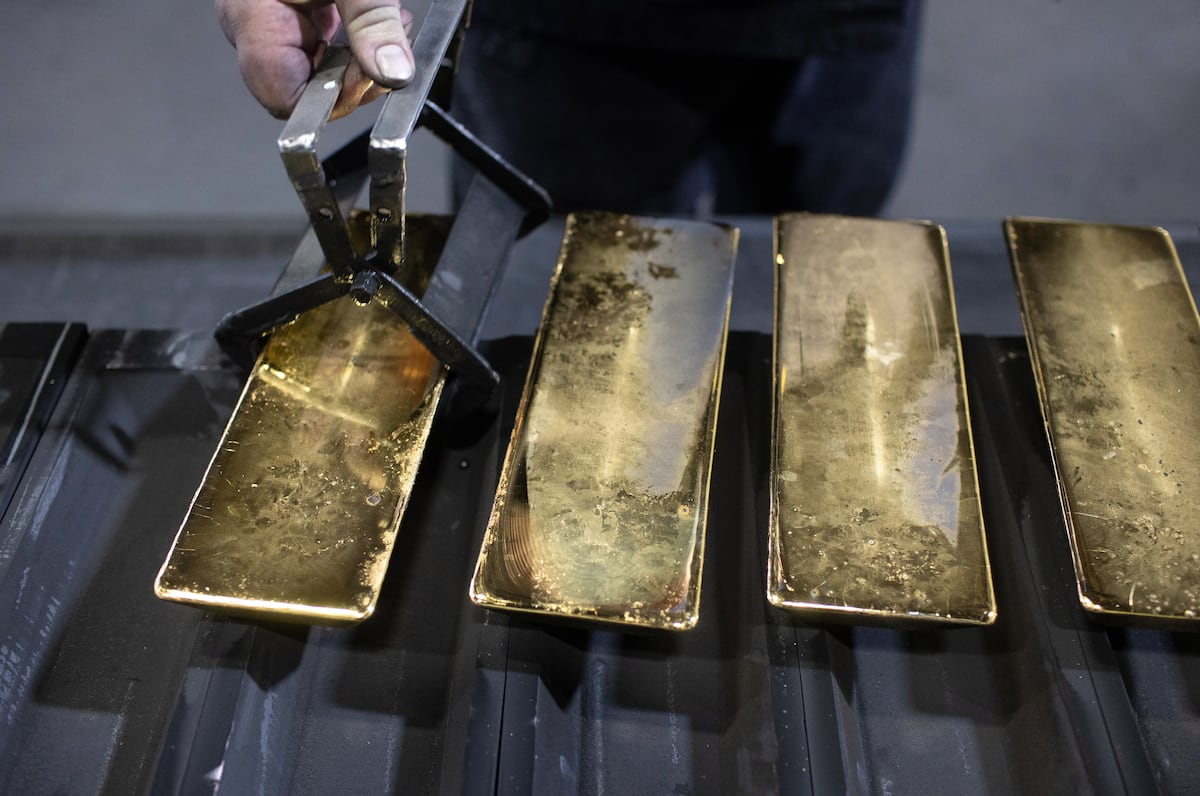

Gold Surges Past $4,000 Mark to All-Time High Amid Global Uncertainty

Gold prices have soared past $4,000 an ounce to an all-time high, driven by global uncertainty, robust demand from central banks, funds, and record ETF investments, solidifying its safe-haven status.

Overview

- Gold futures in New York have surged past $4,000 an ounce, reaching an unprecedented all-time high, marking a significant milestone in the commodities market.

- This record surge is primarily driven by global uncertainty and robust demand from funds and speculators, who view gold as a crucial safe-haven investment.

- Central banks globally have been consistently buying over 1,000 tonnes of gold annually since 2022 to diversify their reserves and lessen dependence on the U.S. dollar.

- Investor interest is also soaring, with a record $64 billion poured into gold-backed exchange-traded funds this year, reflecting strong market confidence.

- Analysts, including Goldman Sachs, project gold prices could climb further to $4,900 per ounce by December 2026, indicating continued bullish sentiment for the metal.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources provide a neutral and comprehensive analysis of gold's record surge. They attribute the rally to a confluence of factors, including global uncertainty and central bank buying, while also presenting crucial counterpoints and risks like potential interest rate hikes. This balanced approach offers readers a multifaceted understanding of the market dynamics.

Articles (7)

Center (2)

FAQ

The surge in gold prices is primarily driven by global uncertainty, robust demand from central banks, funds, and record ETF investments, as investors seek safe-haven assets.

Central banks have been buying over 1,000 tonnes of gold annually since 2022 to diversify their reserves and reduce dependence on the U.S. dollar.

Analysts, including those from Goldman Sachs, project that gold prices could reach $4,900 per ounce by December 2026, indicating continued bullish sentiment.

History

- 2M

4 articles

4 articles