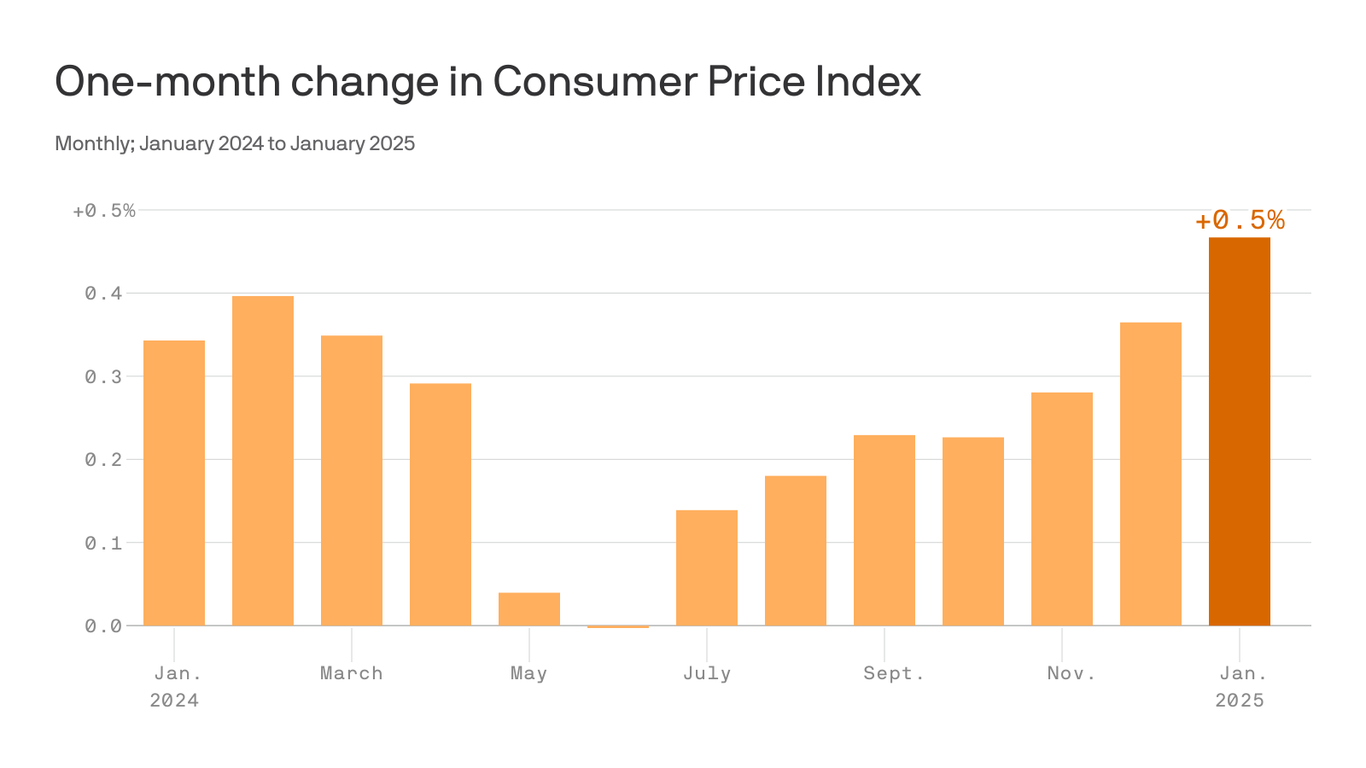

US Inflation Hits 3% in January Amid Tariff Concerns and Fed's Rate Decisions

January's inflation reached 3% due to rising costs in food and energy, affecting Trump's economic strategy and prompting the Fed to hold interest rates steady.

Overview

Inflation in the US surged to 3% in January, driven by escalating prices for groceries, energy, and notably egg prices due to a bird flu outbreak. The Federal Reserve, led by Jerome Powell, indicated that despite President Trump's calls for lower interest rates to counteract rising costs and potential new tariffs, it will maintain its current rate policy as inflation persists above the target of 2%. Analysts caution that Trump's tariffs might exacerbate inflation, complicating efforts to stabilize prices. The market has responded negatively to these developments, reflecting concerns over economic stability.

Report issue

Read both sides in 5 minutes each day

Analysis

Analysis unavailable for this viewpoint.

Articles (21)

Center (14)

History

- 9M

6 articles

6 articles