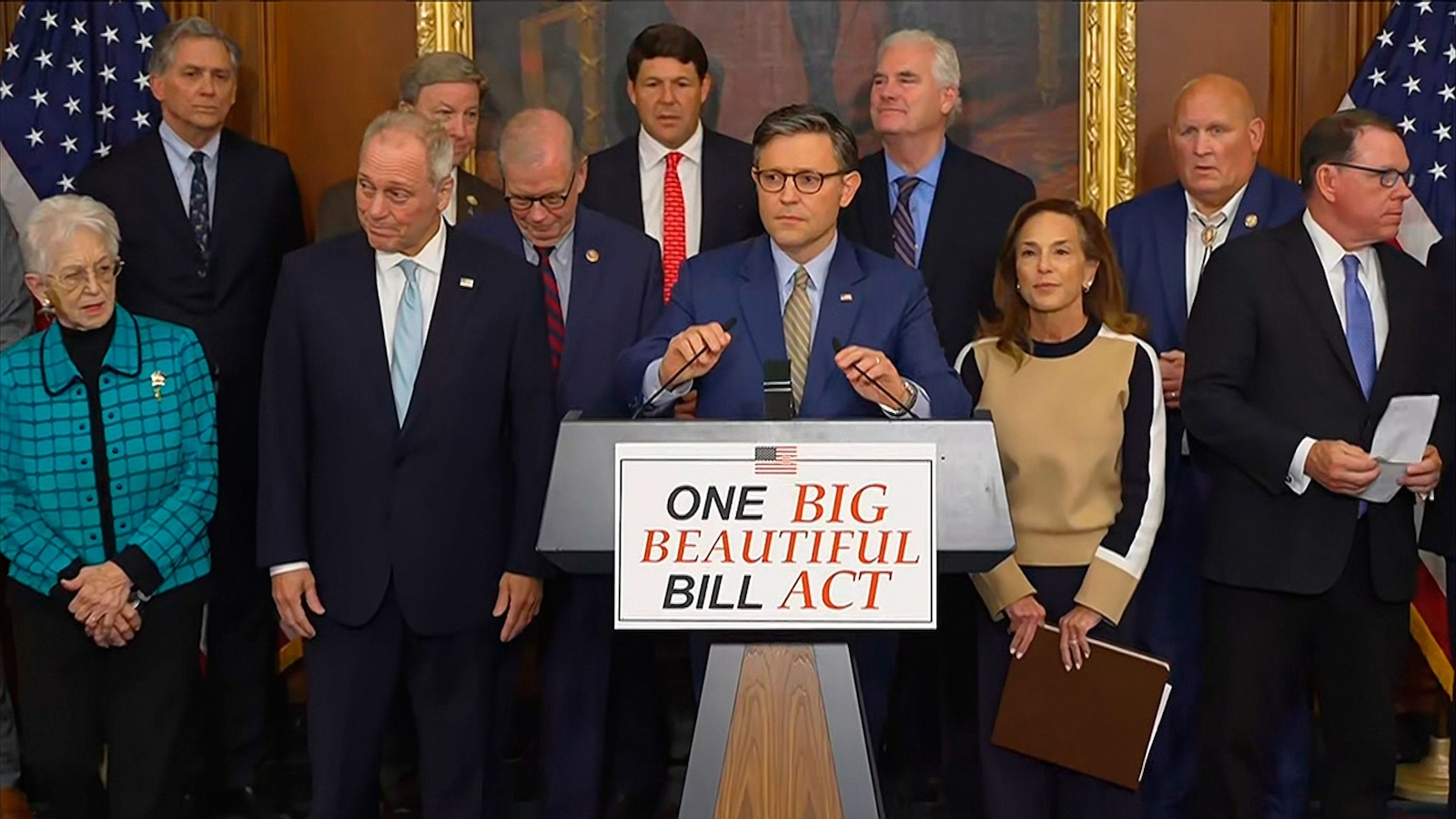

House Passes Trump's 'One Big Beautiful Bill Act' Amid Controversy

The House narrowly passed a $3.8 trillion bill that extends Trump's tax cuts and implements significant cuts to Medicaid and food assistance.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

The House of Representatives passed the 'One Big Beautiful Bill Act' early Thursday, a $3.8 trillion package that extends Trump's tax cuts and implements cuts to Medicaid and food assistance. The bill, which passed by a narrow 215-214 vote, includes key provisions such as raising the SALT deduction cap to $40,000 for incomes under $500,000 and accelerating Medicaid work requirements to 2026. Despite internal GOP divisions, Speaker Mike Johnson expressed confidence in the bill's passage. The Congressional Budget Office estimates the bill could lead to 8.6 million people losing health care coverage over the next decade.

Report issue

Read both sides in 5 minutes each day

Analysis

- The articles present a mix of neutral, negative, and positive tones regarding recent legislation.

- Concerns about social program cuts and impacts on vulnerable populations are prevalent in several articles.

- Republican divisions and internal challenges are highlighted, reflecting a complex political landscape.

Articles (60)

Center (19)

FAQ

The bill extends Trump's tax cuts, raises the SALT deduction cap to $40,000 for incomes under $500,000, accelerates Medicaid work requirements to 2026, and cuts funding for Medicaid and food assistance programs.

The Congressional Budget Office estimates that the bill could result in 8.6 million people losing health care coverage over the next decade due to the Medicaid cuts and work requirement changes.

The bill passed narrowly in the House with a 215-214 vote, indicating significant divisions within the Republican party, although Speaker Mike Johnson expressed confidence in the bill's passage.

The bill raises the SALT deduction cap to $40,000 for incomes under $500,000 and permanently extends and enhances estate and gift tax exemption amounts, increasing them to $15 million for single filers and $30 million for married couples in 2026, with inflation indexing thereafter.

The bill establishes a new tax credit for donations to scholarship-granting organizations, limited to $5,000 per individual annually, supporting education funding through charitable contributions.

History

- 5M

4 articles

4 articles

- 5M

4 articles

4 articles

- 5M

4 articles

4 articles

- 5M

5 articles

5 articles