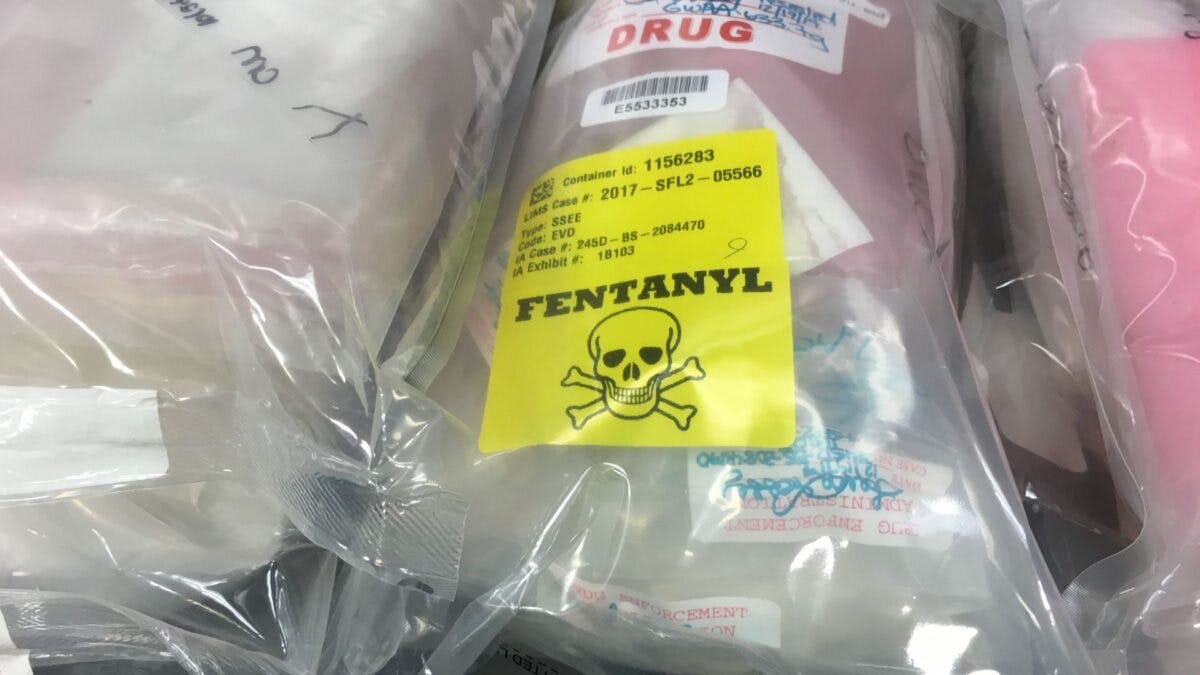

U.S. Sanctions Target Mexican Banks Amid Fentanyl Trafficking Crackdown

The U.S. Treasury has sanctioned multiple Mexican banks for facilitating money laundering for drug cartels, intensifying efforts against fentanyl trafficking.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

- The U.S. Treasury Department has imposed sanctions on several Mexican banks, including Vector and CIBanco, for facilitating money laundering for drug cartels.

- These sanctions aim to disrupt financial operations linked to major cartels, including the Sinaloa, Gulf, and CJNG, involved in fentanyl trafficking.

- The sanctions block money transfers between these Mexican banks and U.S. financial institutions, intensifying the crackdown on drug-related financial activities.

- This action is part of a broader strategy by the U.S. government to combat the opioid crisis fueled by fentanyl trafficking from Mexico.

- The sanctions reflect ongoing efforts to apply pressure on Latin American criminal networks and their financial operations linked to drug trafficking.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources frame the narrative around U.S. sanctions on Mexican banks as a necessary response to ongoing cartel activities. The authors exhibit a critical stance towards the implicated institutions, emphasizing accountability and collaboration between U.S. and Mexican authorities, reflecting a bias towards law enforcement and anti-crime measures.

Articles (7)

Center (1)

FAQ

The Mexican banks sanctioned by the U.S. Treasury are CIBanco, Intercam Banco, and the brokerage Vector Casa de Bolsa.

The sanctions aim to disrupt the financial operations linked to major drug cartels involved in fentanyl trafficking by blocking certain money transfers between these Mexican banks and U.S. financial institutions.

The sanctions target cartels including the Sinaloa, Gulf, and CJNG cartels, which are involved in the trafficking of fentanyl.

The U.S. Treasury imposed these sanctions using a new powerful authority granted by Congress, enabling the Financial Crimes Enforcement Network to target financial institutions tied to illicit opioid trafficking.

The sanctions effectively require U.S. financial institutions to sever ties with the sanctioned Mexican banks, prohibiting certain fund transmissions between them and cutting off their business interactions.

History

- 4M

3 articles

3 articles