Senate Republicans Push for Trump's Tax Plan Amid Rising Concerns and Last-Minute Revisions

Senate Republicans are advancing Trump's tax plan, facing hurdles including Medicaid cuts and a potential delay, while aiming for a July 4 deadline.

Overview

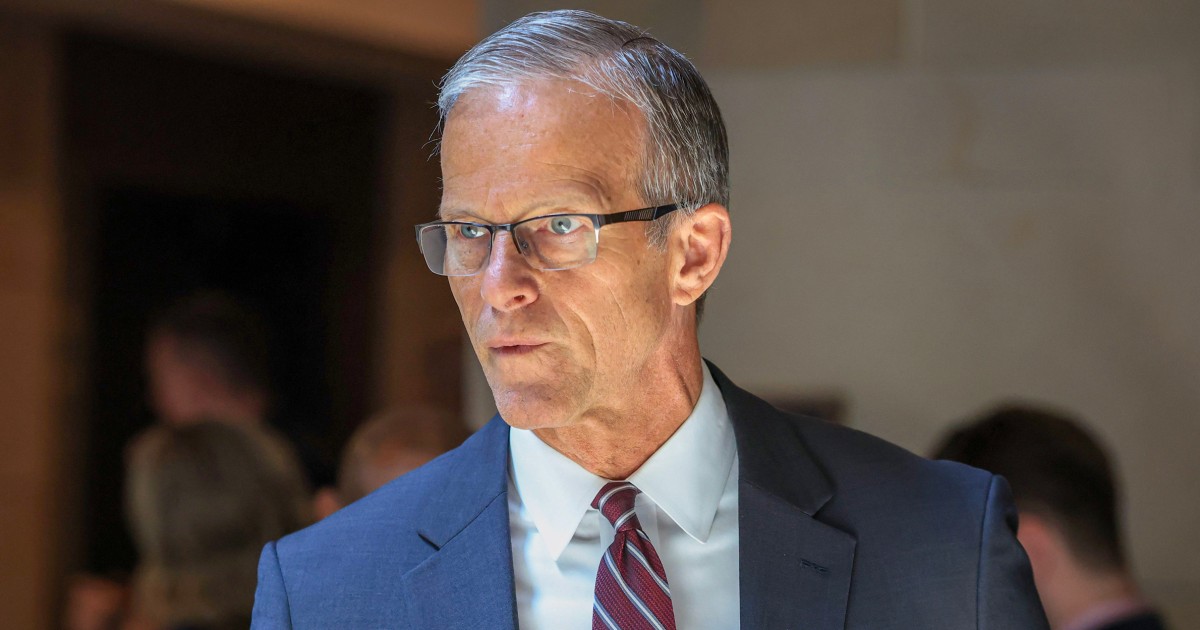

- Senate Majority Leader John Thune is preparing for initial votes on Trump's tax plan, targeting a July 4 deadline despite ongoing challenges.

- Republicans propose a $40,000 SALT cap for five years, differing from the House's 10-year plan, amid concerns over healthcare funding.

- House Speaker Mike Johnson acknowledges potential delays in passing Trump's tax plan as some Republicans express hesitations.

- Senate Republicans are revising the bill to address concerns over Medicaid cuts that could affect millions and threaten rural hospital funding.

- With narrow majorities, Republicans need near-unanimous support to pass the tax plan, facing opposition from Democrats and internal disagreements.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources frame the Republican efforts around Trump's bill as fraught with internal conflict and uncertainty. They highlight struggles for consensus, shifting deadlines, and concerns over fiscal implications, suggesting skepticism about the party's unity and effectiveness. The tone reflects a critical perspective on the legislative process and its challenges.

Articles (19)

Center (8)

FAQ

Senate Republicans face hurdles including internal disagreements, concerns over Medicaid cuts that could affect millions and rural hospital funding, differing proposals on the SALT cap compared to the House, and opposition from Democrats, all while needing near-unanimous support due to their narrow majorities.

The July 4 deadline is a self-imposed goal by Senate Republicans and President Trump to pass the tax plan before the Independence Day holiday; however, both President Trump and House Speaker Mike Johnson have acknowledged the possibility of delays beyond this date due to unresolved issues in the legislation.

The Senate Republicans propose a $40,000 SALT (state and local tax) cap for five years, contrasting with the House's plan which proposes a 10-year SALT cap, reflecting a difference in duration and possibly affecting taxpayers differently.

Budget reconciliation is a fast-track legislative procedure that allows the Senate to pass tax, spending, and debt limit changes with a simple majority vote, bypassing the usual 60-vote filibuster threshold; Republicans are using this process to advance Trump's tax plan amid their slim majorities.

The Senate Republicans are revising the tax bill to address concerns over Medicaid cuts that could negatively impact millions of people and threaten funding for rural hospitals, which has been a significant point of contention within the party.

History

- 4M

3 articles

3 articles

- 4M

8 articles

8 articles

- 4M

3 articles

3 articles