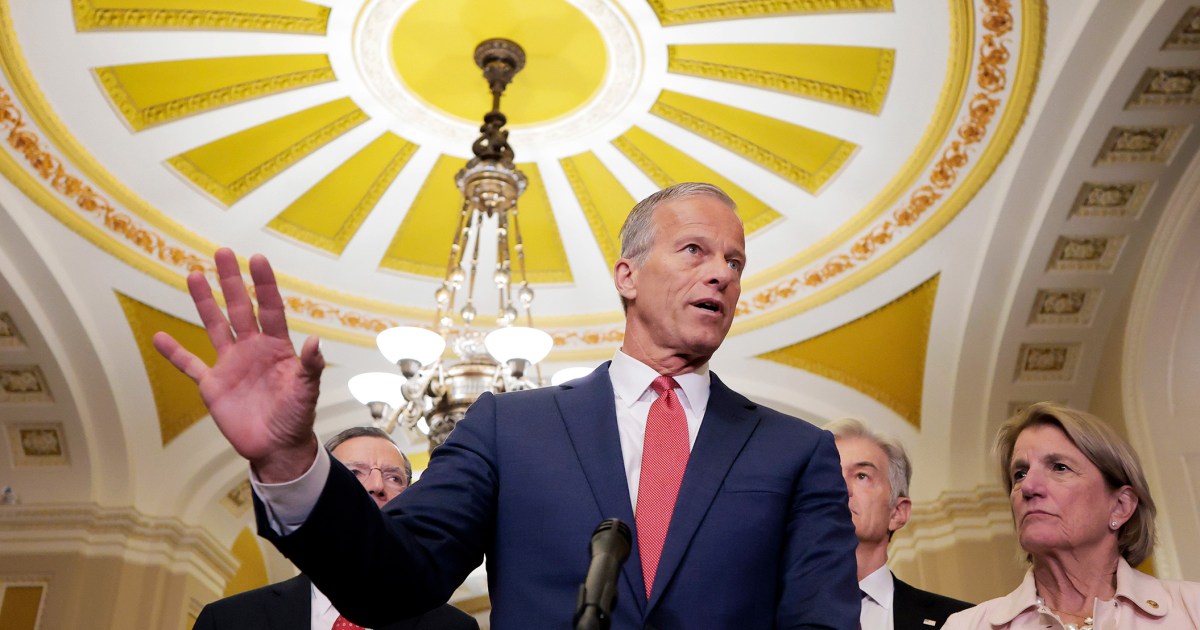

Senate Advances Trump's $4.5 Trillion Tax and Spending Bill Amid Controversy

The Senate is moving forward with Trump's $4.5 trillion tax and spending bill, facing opposition and potential impacts on healthcare and tax breaks.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

- The Senate voted 51-49 to advance Trump's $4.5 trillion tax and spending bill, with Vice President JD Vance casting the tie-breaking vote.

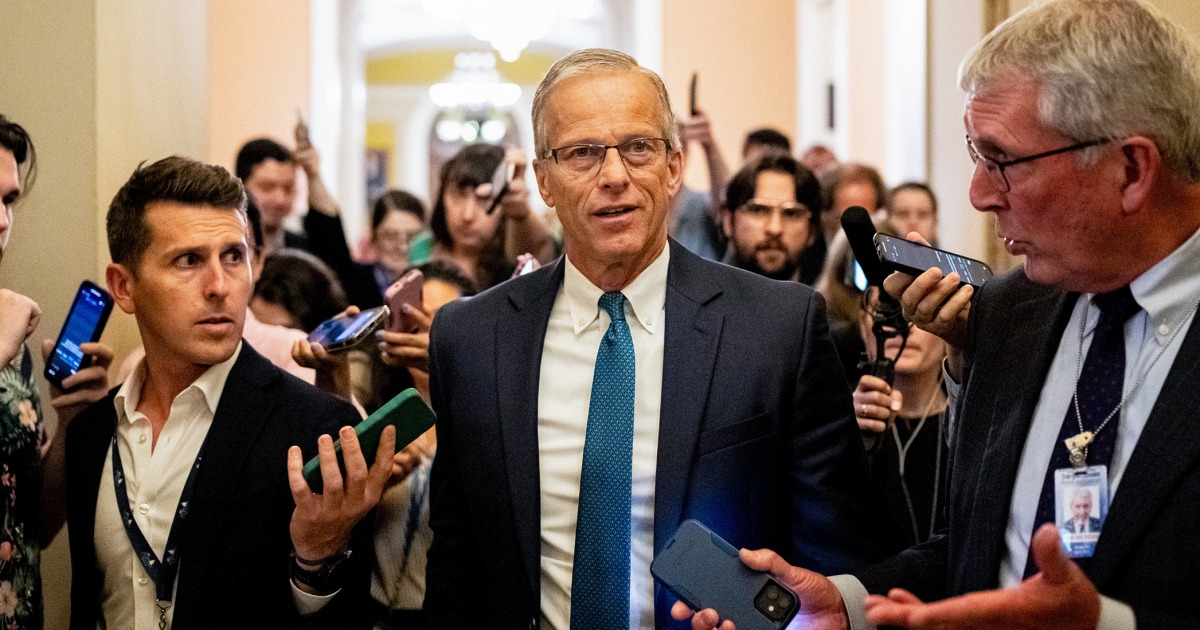

- Republicans emphasize the bill's necessity to prevent tax increases after Trump's first-term tax breaks expire in December.

- The legislation proposes new work requirements for Medicaid and food stamp recipients, targeting adults under 65, amidst concerns over cuts to these programs.

- Democrats are united against the bill, proposing numerous amendments during the Senate's vote-a-rama, highlighting the potential for increased uninsured rates.

- The bill includes significant tax cuts, increased funding for national defense, and provisions affecting renewable energy tax breaks, with a final Senate vote expected soon.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources frame the tax and spending bill as a significant Republican initiative, emphasizing its extensive tax cuts and spending priorities. They highlight Democratic opposition and amendments, suggesting a contentious political landscape. The language reflects a cautious optimism about the bill's passage while acknowledging potential consequences for various demographics.

Articles (42)

Center (14)

FAQ

The bill includes permanent extensions of Trump's 2017 tax cuts, new work requirements for Medicaid and food stamp recipients under 65, significant tax cuts, increased funding for national defense, and changes affecting renewable energy tax breaks.

The Senate voted 51-49 to advance the $4.5 trillion tax and spending bill, with Vice President JD Vance casting the tie-breaking vote.

Democrats oppose the bill due to potential cuts leading to increased uninsured rates and the imposition of work requirements on Medicaid and food stamp recipients, which they argue could harm vulnerable populations.

The Senate reconciliation bill is likely to add between $3.5 and $4.2 trillion to the national debt over the coming years due to deficit-financed tax cuts and spending provisions.

Republicans argue the bill is necessary to prevent tax increases that would occur after the expiration of Trump's original tax breaks in December, emphasizing its role in promoting economic growth and funding national defense.

History

- 4M

9 articles

9 articles

- 4M

5 articles

5 articles

- 4M

4 articles

4 articles

- 4M

5 articles

5 articles

- 4M

8 articles

8 articles

- 4M

3 articles

3 articles