Trump Signs Controversial One Big Beautiful Bill Act on Independence Day

President Trump signed the One Big Beautiful Bill Act into law during a Fourth of July celebration, amidst criticism and concerns over its impact on the national debt and healthcare.

Trump signs One Big Beautiful Bill Act at White House

World News Group

Trump hails 'greatest victory yet' as he signs OBBB into law

Washington Examiner

President Trump Signs 'Big Beautiful Bill' Into Law

TIME Magazine

WATCH LIVE: Trump to sign 'big, beautiful bill' into law

Washington Examiner

Trump heads into July 4 holiday with several wins

Washington Examiner

Trump’s ‘Big Beautiful Bill’ Cements GOP Dominance

TIME Magazine

Congress passes Big Beautiful Bill

World News Group

Trump’s Megabill and the New Art of G.O.P. Capitulation

The New Yorker

What Trump did to lock in the ‘big, beautiful' vote

Washington Examiner

House passes Big Beautiful Bill Act after day of wrangling

World News Group

Republicans Pass Megabill, GOP Rebels Cowed

The Bulwark

Breaking: House Casts Final Vote on 'Big Beautiful Bill'

Western Journal

House Republicans Pass Trump's 'Big Beautiful Bill'

TIME Magazine

House GOP hands Trump 'big, beautiful bill' victory

Washington Examiner

Trump scrambles to close the deal

The Spectator World

House Republicans break standstill and advance ‘big, beautiful bill'

Washington Examiner

Trump blasts GOP holdouts on 'big beautiful bill': 'MAGA is not happy'

Washington Examiner

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

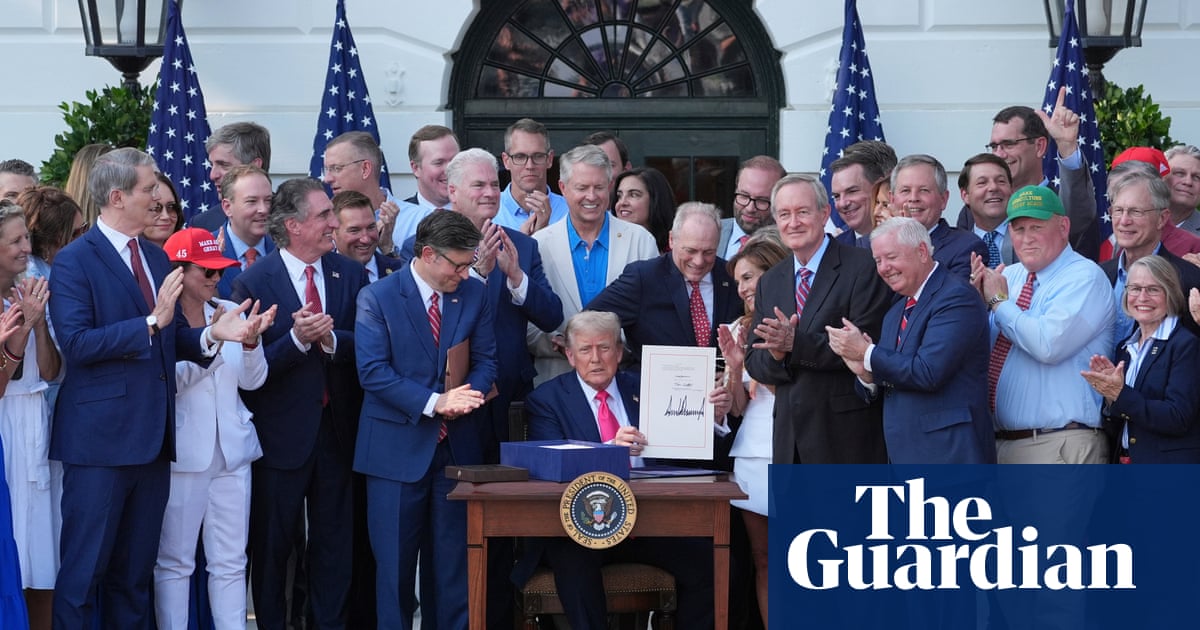

- President Trump signed the One Big Beautiful Bill Act into law during a Fourth of July celebration at the White House.

- The bill, passed by narrow margins, adds $3.3 trillion to the national debt over the next decade.

- Trump praised Republican leadership during the signing and criticized Democrats for opposing the bill.

- The legislation makes previous tax cuts permanent, cuts Medicaid funding, and increases military and immigration enforcement spending.

- Critics warn the bill will negatively impact healthcare access and disproportionately benefit the wealthiest Americans.

Report issue

Read both sides in 5 minutes each day

Analysis

Left-leaning sources frame the legislation as detrimental to everyday Americans, emphasizing its potential to exacerbate inequality and increase the national debt. They express skepticism towards the bill's benefits, highlighting its alignment with wealthy interests and critiquing the Republican support for Trump's agenda, reflecting a clear bias against the administration's policies.

"The new law is unprecedented in many ways, extending the tax cuts of Mr. Trump's first term along with others to the tune of $4.5 trillion, adding another $1.4 trillion in spending cuts and, according to the Congressional Budget Office, adding a record $3.2 trillion to the deficit over the next 10 years."

"The bill Trump signed into law on Friday is unpopular among the American public, and for good reason."

"Whether the American public comes to see the “Big Beautiful Bill” as “beautiful” remains to be seen."

"The bill’s passage and signing constitute a major policy win for a second-term president who displayed complete control over the Republican Party."

"The law will significantly cut taxes, building on the 2017 tax cuts during Trump’s first term."

"The bill combines tax reductions, spending hikes on defence and border security, and cuts to social safety nets."

"The massive legislation that Trump plans to sign Friday will make his campaign promises a reality by extending tax cuts enacted during his first term, and creating new deductions aimed at the working-class voters who backed his re-election."

"Trump's victory further strengthens his power in Washington and clears the way for him to take even more aggressive actions on immigration, trade policy and depart from American tradition to hammer the chair of the Federal Reserve Jerome Powell into lowering interest rates, a move that could give the U.S. economy a sugar high of cheap cash."

"The so-called One Big Beautiful Bill overcame thin Republican majorities and weeks of tense negotiations just meeting the president's self-imposed Independence Day deadline."

"Trump's reckless assault on American institutions and millions of its most vulnerable people would not be possible without the Republican Party’s capitulation and active compliance."

"But while the GOP may call the budget bill big and beautiful, the road to passing the final legislation has been particularly ugly."

"the ambitious tax reform, on which Trump is pinning the success of his domestic economic agenda, deserved to enter its final phase and be resolved in the form it arrived from the Senate on Tuesday."

"The pitiful House Republican conference that Americans are watching in 2025, in other words, is a relatively new phenomenon — and a reminder that the contemporary GOP is less of a political party and more of an embarrassing personality cult."

"The bill contains a bounty of disastrous policies that enshrine tax cuts for the rich while soaking the poor, and will cut over $1.1 trillion from Medicaid, Medicare, and the Affordable Care Act over the next 10 years, resulting in nearly 12 million people losing their health coverage."

"The legislation is expected to speed up and expand Immigration and Customs Enforcement deportations, and will probably make Trump’s longstanding desire for a wall along the border with Mexico a reality."

"Ultimately, however, its passage through narrow Republican majorities is the most consequential demonstration yet of how tightly Trump controls his party."

"Republicans did what Trump wanted, and practically tripped over themselves to appease him — shoving low-income and working-class Americans into even more dire economic conditions than they’re already in as the president continues to remake the nation around the interests of the rich."

"For opponents of the most regressive legislative proposal in a generation, which is poised to do devastating harm to the nation’s health care system and finances, among many other areas of concern, the options have run out."

"The package’s eventual passage marked a significant milestone for the Trump Administration, which had worked with Congress for months to compile a long list of GOP priorities that could form the most defining measure of Trump’s return to the White House."

"The bill also pours tens of billions of dollars into immigration enforcement, one of Trump’s top priorities, and it will also cement the 2017 tax cuts that Trump championed during his first term as president."

"The Republican budget bill making its way through Congress would likely cause those numbers to surge, adding millions of people to the rolls of the uninsured."

"The legislation contains most of Trump’s top domestic priorities, from tax cuts to immigration enforcement."

"The outcome would be a milestone for the president and his party, a longshot effort to compile a long list of GOP priorities into what they call his “one big beautiful bill,” an 800-plus page package."

"The standoff over the Trump administration’s flagship domestic policy package, dubbed the One Big Beautiful Bill, stretched into the early hours of Thursday, as the Republican leadership worked furiously to try to persuade holdouts to send the bill to Trump’s desk by a Friday, July 4 deadline, US Independence Day, while Trump railed against the rebels on social media."

"The wildly unpopular “Big Beautiful” reconciliation package continues to face challenges, though Senate Republicans still hope to bring it to the floor by this weekend."

Center-leaning sources frame the legislation as controversial, emphasizing its implications for tax cuts and government spending. They express skepticism about its impact on social programs and immigration enforcement, reflecting a critical perspective on Trump's policies. The tone suggests concern over potential negative consequences for vulnerable populations.

"The president signed the legislation, which will bring massive cuts to government benefits such as Medicaid and increase funding for immigration enforcement, during the White House's military family picnic on Friday evening."

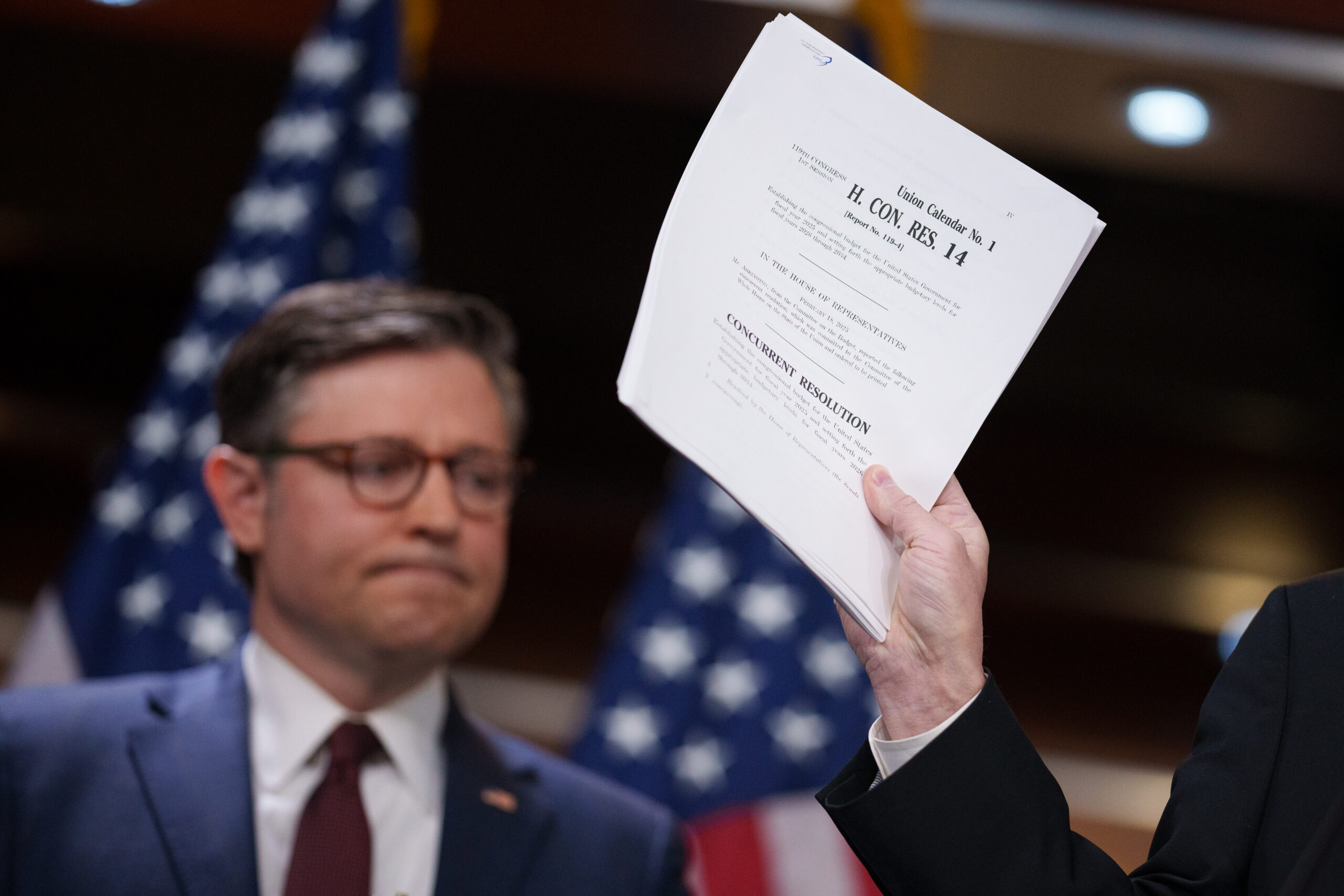

"The bill signing capped a grueling monthslong process, during which the House and the Senate publicly quarreled over whether the GOP should try to pass Trump’s domestic policy priorities in one bill or break them up into two."

"President Trump is bringing pomp and circumstance to his signing of the "big, beautiful bill" on Friday, with a 4 p.m. Independence Day ceremony at the White House."

"The bill’s passage through Congress, regardless of the hurdles along the way, displays Trump’s influence over the Republican Party that many of his predecessors would have envied."

"The mega-bill does not include provisions a stimulus check, despite Trump previously floating that he would consider a payment connected to claimed savings from the Department of Government Efficiency."

"The legislation’s passage was a direct outgrowth of the GOP election sweep that gave them the White House and majorities in both the House and the Senate."

"The bill that passed, among many other things, will add an even larger sum to the national debt—concerns about which were once the leitmotif of the hard right."

"The outcome delivers a milestone for the president, by his Friday goal, and for his party."

"The Congressional Budget Office projects that the bill would increase federal deficits over the next 10 years by nearly $3.3 trillion from 2025 to 2034."

"The bill is projected to increase the national debt by $3.3 trillion over a decade, with the nonpartisan Congressional Budget Office finding that the revenue losses of $4.5 trillion outstrip the spending cuts of $1.2 trillion."

"The sprawling GOP bill — clocking in at nearly 1,000 pages — represents a dramatic realignment of the federal government's role in American life, shifting resources from the social safety net and investments in clean energy, and reorienting them to finance trillions of dollars in new spending on tax cuts, immigration enforcement and national defense."

"Lawmakers in the House pulled an all-nighter on the massive domestic policy package for President Donald Trump’s agenda, as a handful of Republican holdouts stalled the procedural “rule” vote for several hours."

"The plan would extend tax cuts from the first Trump administration and introduce additional tax breaks, reducing government revenues."

"Trump and Republicans leaders in Congress are now on the cusp of a major victory."

"The sprawling GOP bill — clocking in at nearly 1,000 pages — represents a dramatic realignment of the federal government's role in American life, shifting resources from the social safety net and investments in clean energy, and reorienting them to finance trillions of dollars in new spending on tax cuts, immigration enforcement and national defense."

"The outcome would be milestone for the president and his party, a longshot effort to compile a long list of GOP priorities into what they call his “one big beautiful bill,” an 800-plus page package."

"The Senate on Sunday afternoon began debate on President Donald Trump's megabill for his second term priorities after a dramatic procedural vote late Saturday night."

Right-leaning sources frame the One Big Beautiful Bill Act as a significant victory for President Trump, emphasizing its potential economic benefits and alignment with his agenda. They exhibit a bias towards portraying the bill positively while criticizing dissenting Republicans, reflecting a strong support for Trump's leadership and policies.

"President Donald Trump signed the One Big Beautiful Bill Act into law on Friday during Fourth of July celebrations at the White House."

"The law signed by the president on Friday will make much of his 2017 tax bill permanent while adding other reforms, along with additional spending for the border, the military, and his mass deportation operation."

"Trump called the signing of the bill the “greatest victory yet.”"

"The legislation then headed back to the House to hammer out a few differences in the versions passed in both chambers of Congress."

"The signing of the massive tax and spending bill marks a major legislative win for Trump in his second term."

"The bill is stuffed full of Trump's 2024 campaign trail promises and second-term priorities on tax cuts, immigration, defense, energy and the debt limit."

"President Donald Trump will celebrate the Fourth of July on Friday with a bevy of victories."

"The White House stated that the bill will "create historic economic growth to usher in America’s Golden Age.""

"Trump expressed disappointment in Republican Pennsylvania Rep. Brian Fitzpatrick after he voted “no” on the Big, Beautiful Bill."

"With the Big Beautiful Bill now out of the way, GOP leaders have hinted that Congress may attempt to pass a second domestic policy package sometime in the fall."

"Congress officially passed President "one big, beautiful bill" on Thursday afternoon after back-to-back sleepless sessions for both the House and Senate."

"A group of GOP holdouts had prevented the bill, known as the One Big Beautiful Bill Act, from advancing overnight, but most were persuaded to support it after negotiations with leadership and Trump administration officials."

"The legislation will also fund 5,000 new Customs and Border Protection (CBP) officers, 3,000 new Border Patrol agents and 200 new Air and Marine Operations agents, according to the committee."

"This bill is going to create an economic boom for the United States of America."

"The legislation’s passage was a direct outgrowth of the GOP election sweep that gave them the White House and majorities in both the House and the Senate."

"In the end, only two Republicans voted against the bill, and it's now heading to the president's desk."

"The House of Representatives on Thursday afternoon passed the revised One Big Beautiful Bill Act in a 218-214 vote after a marathon overnight session."

"The Congressional Budget Office projects that the bill would increase federal deficits over the next 10 years by nearly $3.3 trillion from 2025 to 2034."

"Now that it’s passed, small businesses can make tax plans for 2026, waiters and hourly workers can finally catch a break, tax cuts are locked in for the rest of us, and Border Patrol and Immigration and Customs Enforcement have the tools and funding to keep doing their jobs."

"The House passed the bill by a margin of 218 to 214, with all Democrats and two Republicans voting no."

"The changes needed to clear the Senate were greeted with dismay and disdain by the House, to the extent that it was after 3 a.m. Thursday before the final procedural barrier was cleared to bring the bill to the floor of the House."

"The House of Representatives narrowly passed a massive 10-year budget framework, known as the One Big, Beautiful Bill Act, on Thursday in a triumph for the agenda of President Donald Trump and the Republican-controlled Congress."

"None of the wins in the big, beautiful bill would have been possible without Trump."

"The House of Representatives on July 3 passed the One Big Beautiful Bill Act to implement President Donald Trump’s agenda, sending it to the president’s desk."

"The bill now heads to Trump’s desk for his signature, which will likely come Friday."

"It’s a commanding victory for Speaker Mike Johnson, R-La., and for the president himself, both of whom spent hours overnight trying to persuade GOP critics of the bill."

"Trump may feel triumphant tomorrow – and his legislative victory should taste sweet."

"The outcome would be a milestone for the president and his party, a longshot effort to compile a long list of GOP priorities into what they call his “one big beautiful bill,” an 800-plus page package."

"The House voted 219 to 213 to adopt the rule, with one Republican joining all Democrats to vote against the procedural measure."

"The House of Representatives has voted to advance President Donald Trump’s $3.3 trillion "big, beautiful bill" to its final phase in Congress, overcoming fears of a potential Republican mutiny."

"Republican leaders have now kept the rule vote open for over four hours to try to pressure the holdouts to get a majority vote."

"Trump is losing patience with House Republican holdouts as the procedural rule vote on the “big beautiful bill” has remained open for nearly three hours."

"Trump said it is time to give up the opposition and siding with Democrats, who are unilaterally voting no on anti-Trump principle in both the Senate and the House."

"The House voted early Thursday to advance Donald Trump's "big, beautiful bill" to a final vote, leaving the president at the threshold of securing his signature legislative agenda by the Fourth of July."

Articles (76)

Center (17)

FAQ

The One Big Beautiful Bill Act includes making previous tax cuts permanent, cutting Medicaid funding, increasing military and immigration enforcement spending, and raising the statutory debt limit. It also affects USDA programs such as SNAP and modifies tax-related provisions like the estate and gift tax exemptions.

The bill is projected to add $3.3 trillion to the national debt over the next decade.

Critics warn that the bill will negatively affect healthcare access, disproportionately benefit the wealthiest Americans, and contribute significantly to the national debt.

President Trump signed the bill during the Independence Day celebration to highlight the legislative achievement and praised Republican leadership while criticizing Democrats for opposing it.

The bill extends the special depreciation deduction, permanently extends and increases the estate and gift tax exemption to $15 million for single filers and $30 million for married filing jointly, and adjusts thresholds and limitations related to qualified business income deductions.

History

- 4M

9 articles

9 articles

- 4M

5 articles

5 articles

- 4M

13 articles

13 articles

- 4M

22 articles

22 articles

- 4M

8 articles

8 articles

- 4M

9 articles

9 articles