President Trump Defends Economic Policies and Presidency Amidst Low Approval Ratings

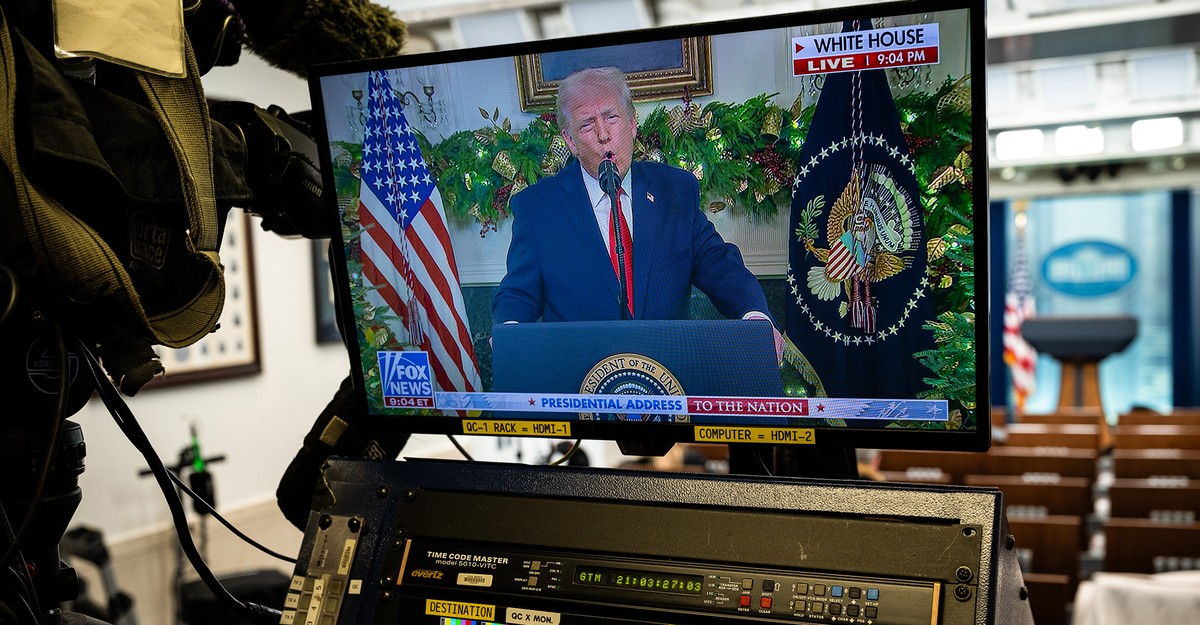

President Donald Trump delivered a primetime Oval Office speech, defending his first 11 months and economic plan. This occurred amidst low approval ratings and public economic concerns.

Overview

- President Donald Trump delivered a rare 20-minute primetime speech from the Oval Office, forcefully defending his first 11 months in office and economic plan.

- The speech aimed to improve his approval rating, which had dipped to 36% for economic management and 42% overall, according to recent polls.

- Trump addressed widespread public dissatisfaction, as 61% of Americans and voters feel the economy is not working well for them personally.

- He also blamed Joe Biden for various issues and accused Americans of being ungrateful during his address to the nation.

- Recent polls indicate that 57% of Americans attribute current economic conditions more to Trump than to Biden, highlighting public perception of responsibility.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources frame this story by highlighting a significant disconnect between President Trump's defense of his first year and public sentiment. They juxtapose his positive claims and policy promises with negative poll data and voter dissatisfaction, suggesting his efforts to address the economy are not resonating with the public.

Articles (6)

Center (3)

FAQ

Recent polls reported approval of Trump’s handling of the economy at 36% and overall approval at 42%, while 61% of Americans said the economy is not working well for them personally; additionally, 57% of Americans attributed current economic conditions more to Trump than to Biden.

Trump defended his first 11 months and his economic plan, which in his administration has included tariffs, state intervention in industries, and tax decisions; independent analyses project that broad tariffs like those his administration implemented could reduce long-run GDP and wages and raise costs for households, while other measures such as executive actions and tax choices affect deficits and sector incentives.

Analyses and reporting show Trump’s steep, near‑universal tariffs since 2025 raised U.S. effective tariff rates substantially, prompted retaliatory tariffs (e.g., from Canada), contributed to trade tensions and a decline in the U.S. dollar, and were linked to negative market reactions including a stock market downturn.

One projection from the Penn Wharton Budget Model estimates that tariffs announced in April 2025 could lower long‑run GDP by about 6% and wages by about 5%, resulting in an estimated lifetime loss of roughly $22,000 for a middle‑income household.

Economists generally find tariffs are regressive and reduce economic efficiency, often harming growth and wages more than equivalent revenue‑raising taxes; analyses suggest the economic harm from broad tariffs can exceed that of comparable tax changes, while tax cuts or spending shifts have different distributional and fiscal trade‑offs evaluated by institutions like the Congressional Budget Office and economic research centers.

History

- This story does not have any previous versions.