Nvidia's $5.5 Billion Loss Sparks Market Decline Amid New Export Controls

Nvidia faces a $5.5 billion charge due to new export regulations, contributing to significant stock declines across the semiconductor industry and broader markets.

Subscribe to unlock this story

We really don't like cutting you off, but you've reached your monthly limit. At just $5/month, subscriptions are how we keep this project going. Start your free 7-day trial today!

Get StartedHave an account? Sign in

Overview

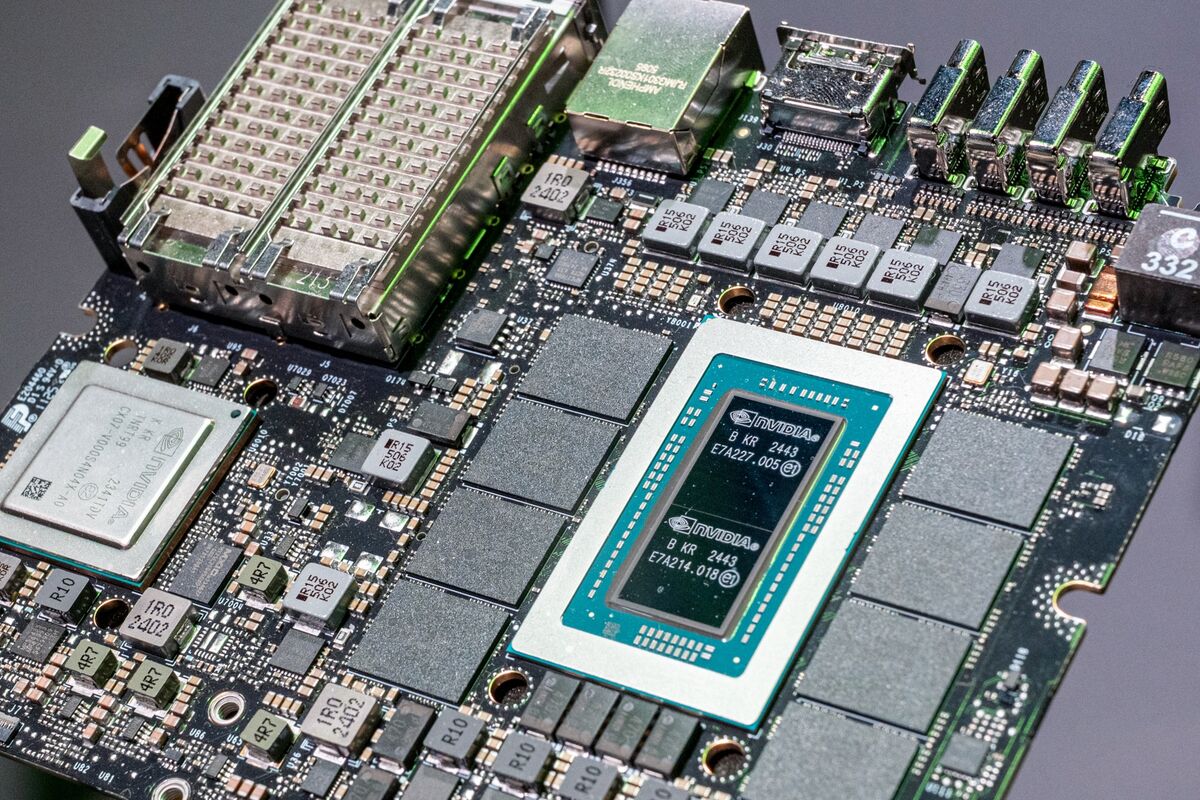

Nvidia announced a $5.5 billion financial loss due to new export restrictions under the Trump administration, targeting its H20 AI chips. This news caused shares to drop 6%, contributing to a broader market downturn, with the Nasdaq falling 2% and the S&P 500 declining 1.1%. The charge represents costs associated with new licensing requirements aimed at preventing the potential use of these chips in Chinese supercomputers. AMD also warned of an $800 million charge due to similar regulations. This uncertainty has triggered a sell-off across the semiconductor sector, impacting companies globally and prompting concerns regarding future tech exports.

Report issue

Read both sides in 5 minutes each day

Analysis

- Nvidia's expected $5.5 billion financial hit due to new U.S. export controls on AI chips highlights the intensifying technology trade conflict between the U.S. and China.

- The Trump administration's tighter controls are aimed at preventing advanced U.S. chips from bolstering China's military capabilities, indicating a strategic stance against China's rise in the AI market.

- While some industry analysts express concern over the restrictions' impact on U.S. tech competitiveness, they recognize that the escalating trade tensions signal a likely continuation of such measures in the future.

Articles (8)

Center (5)

FAQ

The new export restrictions were triggered by U.S. national security concerns over the potential use of Nvidia's H20 chips in Chinese supercomputers or military applications.

The financial impact forces Nvidia to reassess its market strategies. It plans to invest in domestic AI infrastructure, diversify its markets, and explore collaborations to mitigate the loss of the Chinese market.

These restrictions could accelerate China's domestic semiconductor production efforts, leading to shifts in global market dynamics and potentially increasing technological rivalry between the U.S. and China.

History

- 7M

5 articles

5 articles