Nvidia Achieves Historic $5 Trillion Valuation as AI Investment Surges

Nvidia achieved a historic $5 trillion market valuation, becoming the first company globally, fueled by massive AI investments and investor confidence, boosting CEO Huang's wealth.

Overview

- Nvidia achieved a historic $5 trillion market capitalization, becoming the first company globally and surpassing major economies and tech giants like Microsoft and Apple.

- Nvidia's valuation is fueled by investor confidence in AI spending, with AI-related enterprises driving 80% of this year's stock market gains and shares surging over 50%.

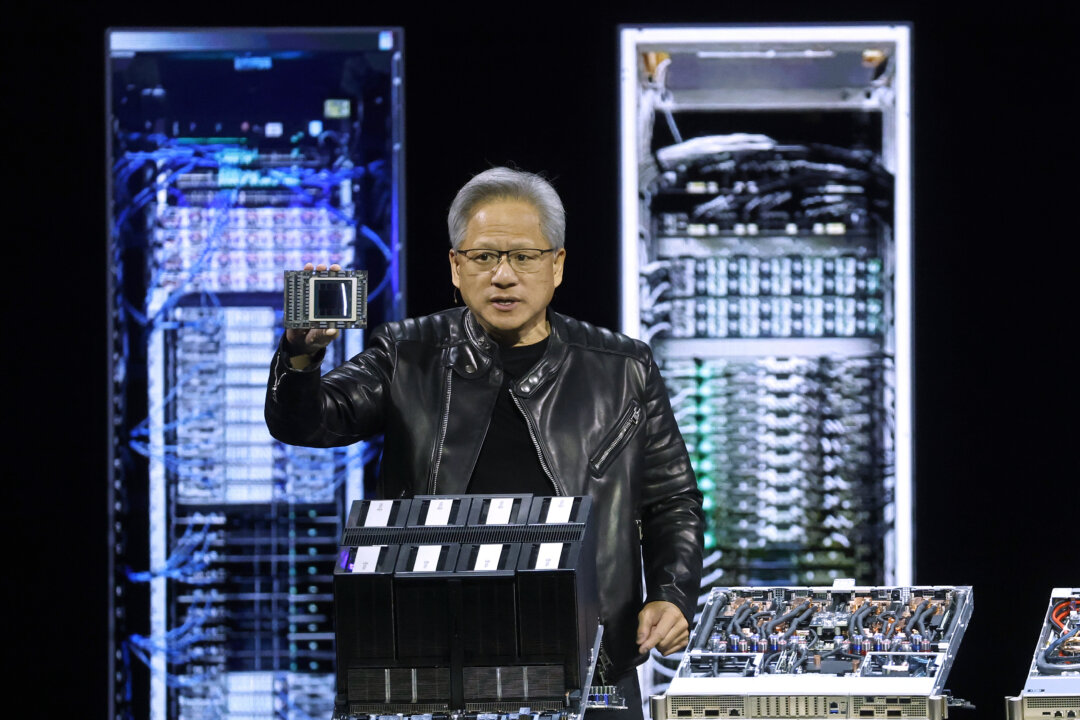

- Nvidia's growth is fueled by over $500 billion in AI chip orders, strategic collaborations including building seven new AI supercomputers, and significant investments in AI development.

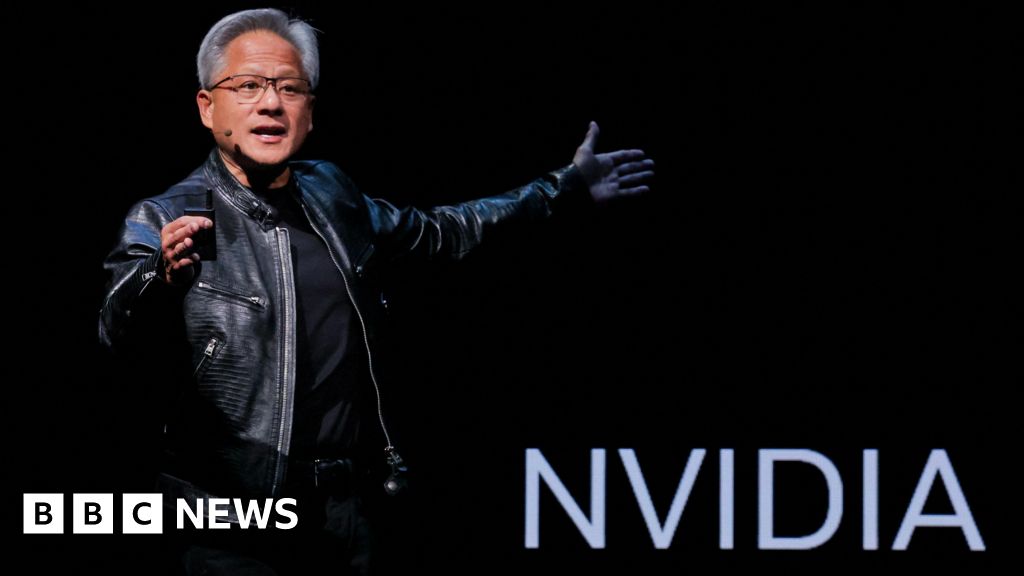

- CEO Jensen Huang's stake in Nvidia is valued at approximately $179.2 billion, making him the eighth richest person according to Forbes, reflecting the company's immense success.

- Nvidia will report quarterly results on November 19, having returned money to shareholders via stock buybacks and dividends in fiscal 2026, showcasing its strong financial position.

Report issue

Read both sides in 5 minutes each day

Analysis

Center-leaning sources cover Nvidia's milestone neutrally, focusing on factual reporting and quantifiable achievements. They present the company's rapid growth and market impact through objective data points, avoiding speculative language or partisan commentary. The coverage emphasizes the financial significance of Nvidia's ascent to the $5 trillion club without editorializing its implications.

Articles (13)

Center (10)

FAQ

Nvidia's $5 trillion market cap is driven by surging stock prices, overwhelming demand for AI chips including the Blackwell GPU architecture, securing over $500 billion in AI chip orders, strategic partnerships such as building AI supercomputers with the Department of Energy, and major investments in AI companies like OpenAI and Nokia.

Nvidia holds an estimated 75% to 90% market share in the AI chip segment and dominates 92% of the discrete desktop and laptop GPU market as of early 2025, making it the leading provider of GPUs critical for AI model training and deployment.

Nvidia is collaborating with the U.S. Department of Energy to build seven new AI supercomputers, has committed $100 billion in investments in OpenAI, and invested $1 billion in Nokia to advance AI and 6G networking development.

For fiscal year 2025, Nvidia generated $130.5 billion in revenue, a 114% increase from the previous year, with data center revenue—largely AI-focused—contributing around $102 billion, reflecting its growth driven by AI technologies and products like the Blackwell GPUs.

History

- 23h

9 articles

9 articles