UK Inflation Cools While US Sees Uptick as Economic Sentiments Shift

UK inflation drops to 2.5% in December, easing pressure on government; US inflation rises to 2.9%, complicating rate cut forecasts.

Biden's Parting Gift: Inflation Accelerated In December

Breitbart News

Inflation rises 2.9% in 2024 as consumer prices heat up heading into 2025

Straight Arrow News

Inflation accelerated as expected in December

Business Insider

Overview

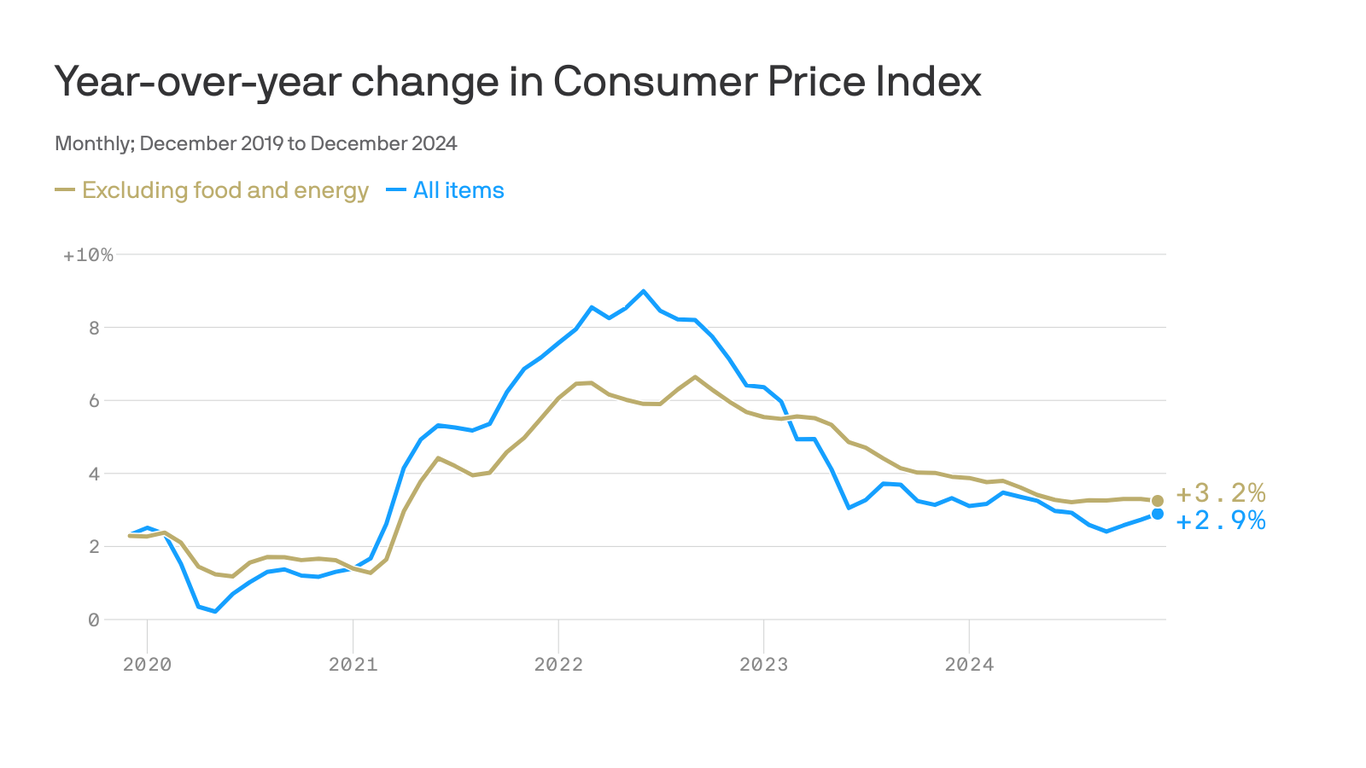

In December, UK inflation dipped to 2.5%, helping reduce government borrowing costs and raising expectations for potential Bank of England rate cuts. Meanwhile, US inflation rose to 2.9%, driven by energy prices. Core inflation in the US held at 3.2%. Concerns over US tariffs under President-elect Trump add uncertainty. Analysts suggest the reduced UK inflation offers the Bank of England more leeway for interest rate adjustments, as UK bond yields fell significantly, providing some relief amid broader global market volatility. The economic outlook remains cautious as rising energy prices could impact future inflation.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

- The decrease in UK inflation to 2.5% is interpreted as a positive signal for potential interest rate cuts, relieving financial pressures on families and indicating a steady economic management under Chancellor Rachel Reeves' direction.

- Chancellor Rachel Reeves is praised for her dynamic approach to economics, emphasizing fiscal growth, fair taxation, and plans to increase the national minimum wage to support blue-collar workers.

- Despite the recent decline in inflation, there are rising concerns over potential fluctuations due to escalating energy costs and the impact of government borrowing, highlighting the need for prudent economic oversight.

Analysis unavailable for this viewpoint.

- The U.S. inflation rate increased by 2.9% in December, driven primarily by rising energy and food prices, indicating persistent economic challenges that could strain household budgets.

- Higher costs associated with essential goods such as groceries and gas have compounded economic pressures, with over 40% of the CPI increase attributed to the climbing energy prices.

- The Federal Reserve faces a complicated decision-making process as inflation remains above target levels despite previous rate cuts, suggesting that sustained relief for consumers remains uncertain.

Articles (33)

Center (19)

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

No highlight available for this article.

History

- 6M

4 articles

4 articles

- 6M

4 articles

4 articles

- 6M

6 articles

6 articles