Bitcoin Dips Below $90,000 Amid Economic Concerns and Major Exchange Hack

Bitcoin's price falls sharply below $90,000, influenced by market volatility, regulatory fears, and a historic $1.5 billion hack.

Overview

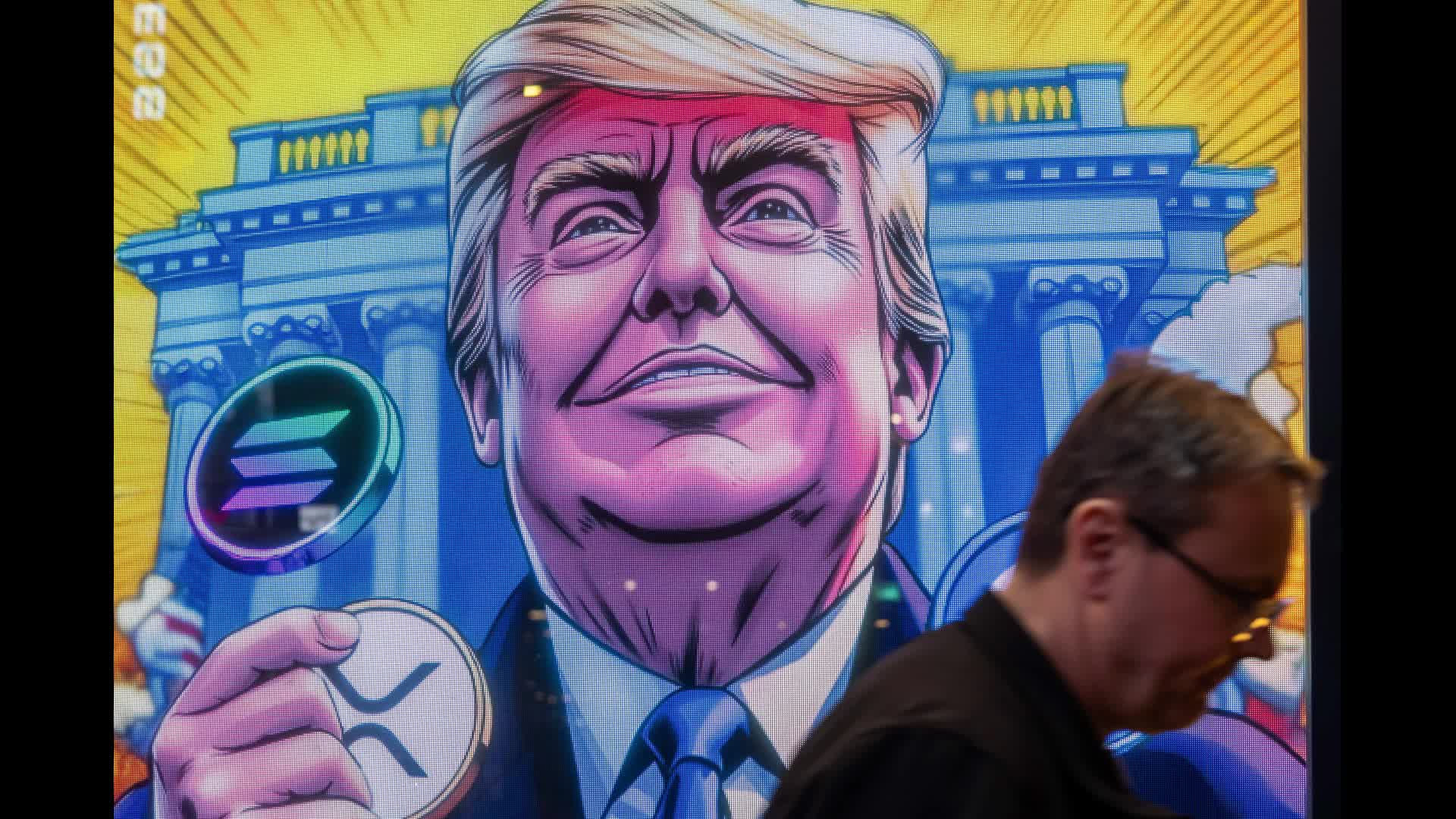

Bitcoin's price plunged below $90,000 for the first time since November, losing over 20% from its peak during Trump's inaugural rally. Other cryptocurrencies like Ethereum and Solana also suffered steep losses, as concerns over the U.S. economy grew following a significant drop in consumer confidence. Additionally, a $1.5 billion hack of the Bybit exchange aggravated market fears, highlighting vulnerabilities in the digital asset space. Despite the downturn, some investors remain optimistic, seeing buying opportunities, as pro-crypto politicians pledge regulatory support amid ongoing industry turmoil.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

- Bitcoin has dropped below $90,000, reflecting a broader decline in cryptocurrencies as consumer confidence falls, despite a pro-crypto agenda from the Trump administration.

- While the cryptocurrency market is highly volatile, some view the price drop as a buying opportunity, given that Bitcoin is still significantly up since Trump's election.

- Recent hacks and scandals, like the $1.5 billion theft from Bybit, highlight vulnerabilities in the crypto industry, underscoring the need for consumer protections as regulations evolve.

Articles (6)

Center (3)

FAQ

The outlook for Bitcoin's price recovery is uncertain. While some investors see buying opportunities, the lack of new bullish catalysts and ongoing market volatility pose significant challenges. Bitcoin needs to hold above key support levels to potentially recover.

Other cryptocurrencies, such as Ethereum and Solana, have also experienced significant losses. Ethereum dropped by about 9.5%, and smaller cryptocurrencies like Dogecoin saw declines of around 20%.

History

- 4M

3 articles

3 articles