Trump Tariffs on Imports Trigger Global Retaliation and Falling Stock Markets

New tariffs on Canada, Mexico, and China have led to retaliatory measures, causing stock market declines and fears of rising consumer prices.

Overview

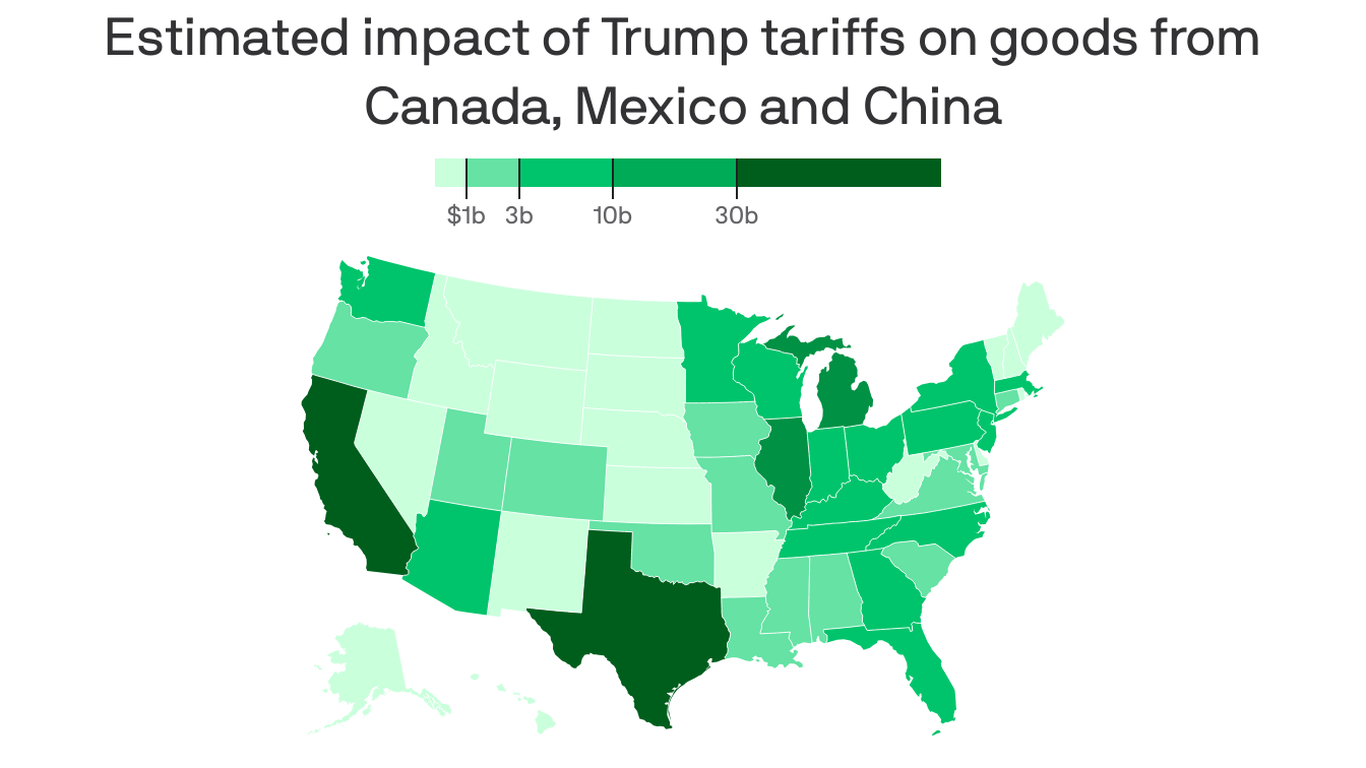

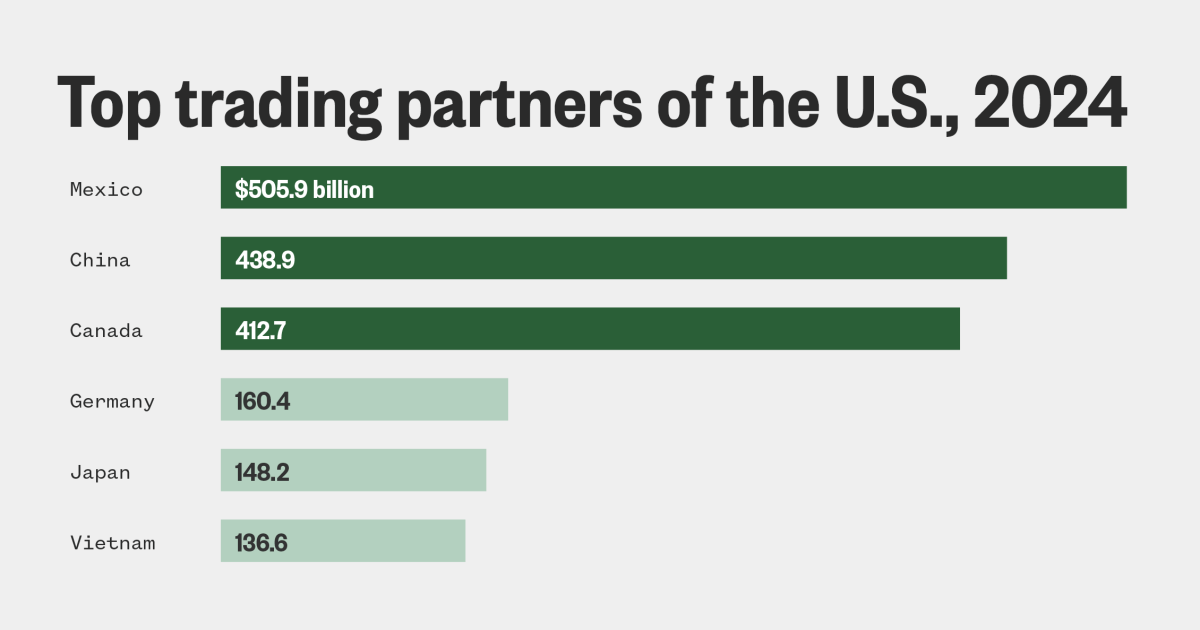

President Trump's 25% tariffs on imports from Canada and Mexico took effect on March 4, 2025, alongside a rise in tariffs on China from 10% to 20%. These tariffs prompted swift retaliatory actions from Canada, imposing 25% tariffs on over $100 billion in U.S. goods, and Mexico planning similar measures. Market reactions included a significant decline in global stock indexes, with the S&P 500 and NASDAQ losing ground. Industry groups warned consumers could see price hikes across multiple sectors, including automotive and agriculture, as mounting costs filter through supply chains.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

- Trump's tariffs on Canada and Mexico currently face backlash, with significant retaliatory measures in place, prompting concerns about economic instability and inflation affecting U.S. households.

- The direct economic impact of tariffs may lead to rising prices for consumer goods, as evidenced by analysts predicting an increase in costs for products such as groceries, automotive parts, and goods reliant on cross-border supply chains.

- While the administration asserts that the tariffs are designed to protect American jobs and industries, experts emphasize the risks of exacerbating economic tensions and potential long-term consequences for trade relations.

Articles (46)

Center (29)

FAQ

The U.S. has imposed a 25% tariff on most imports from Canada and Mexico, with a 10% tariff on Canadian energy resources. For China, the tariff has increased from 10% to 20%.

Canada has announced retaliatory tariffs on over $100 billion in U.S. goods, while Mexico plans to implement similar measures, possibly focusing on precision strikes against U.S. products.

The imposition of tariffs led to significant declines in global stock indexes, including the Dow Jones Industrial Average, S&P 500, and NASDAQ.

History

- 4M

6 articles

6 articles