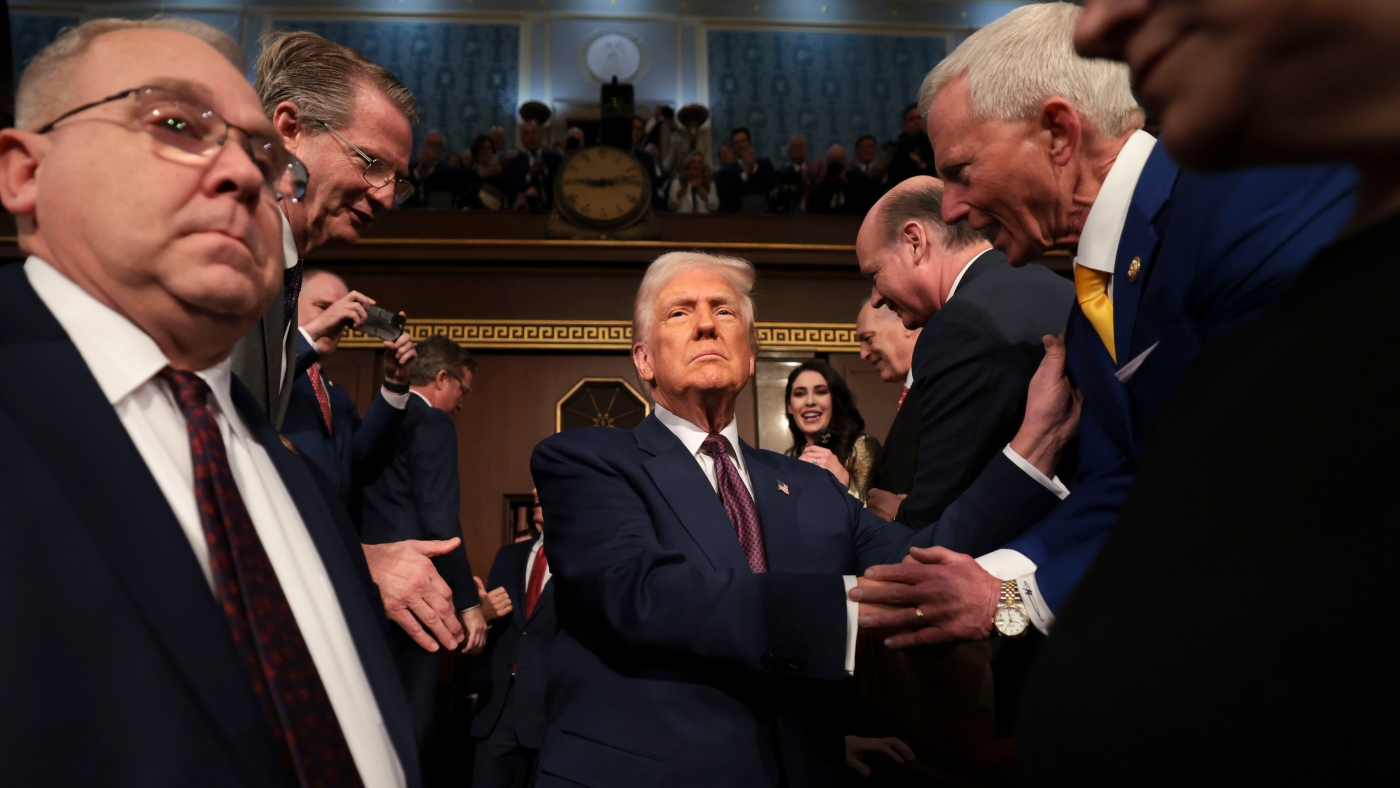

Market Turmoil Amid Trump’s Tariff Turbulence

European markets decline as President Trump’s unpredictable tariff policies create global economic uncertainty, exacerbated by new import exclusions and the ECB's cautious rate cuts.

Overview

European markets fell considerably, weighed down by President Trump's inconsistent tariff policies affecting U.S.-Canada-Mexico trade relations. The Stoxx 600 index dropped 0.65%, with high-end luxury stocks hit hard. Trump's temporary tariff exemptions complicate trade dynamics, while the ECB’s recent rate cut alongside changing defense budgets adds to market volatility. China's response to U.S. tariffs continues to unfold amid record export figures. Key shifts may influence inflation and growth forecasts alongside regional geopolitical tensions, highlighting the broader implications of these trade policy developments.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

- European markets are experiencing volatility due to U.S. tariff policies, ECB rate cuts, and changes in defense spending.

- Tariffs implemented by Trump on Mexican and Canadian imports have led to market uncertainty and could result in higher consumer prices.

- Analysts express concerns about the long-term economic impact of tariffs on U.S. businesses and potential retaliatory measures from affected countries.

Articles (6)

Center (6)

FAQ

European markets have experienced volatility, with declines in certain sectors like luxury stocks. The Stoxx 600 index dropped 0.65% due to uncertainty over Trump's tariff policies affecting U.S.-Canada-Mexico trade relations.

Trump's tariff policies have led to significant backlash from trading partners like Canada and Mexico, who are imposing retaliatory tariffs on U.S. goods. This has escalated fears of a global trade war and increased uncertainty in international trade.

The ECB's cautious rate cuts aim to stabilize the economy, but ongoing trade tensions and changing defense budgets add to market volatility. The ECB must balance economic growth with inflation concerns, which are complicated by global trade uncertainties.

These developments heighten regional geopolitical tensions, particularly between the U.S. and its major trading partners. The ongoing trade disputes could influence inflation and growth forecasts, affecting global economic stability and regional alliances.

History

- This story does not have any previous versions.