Stock Market Plummets Amid Tariff Uncertainty and Economic Concerns

Wall Street sees major sell-offs as uncertainty from Trump’s administration weighs heavily on market performance and investor sentiment.

Overview

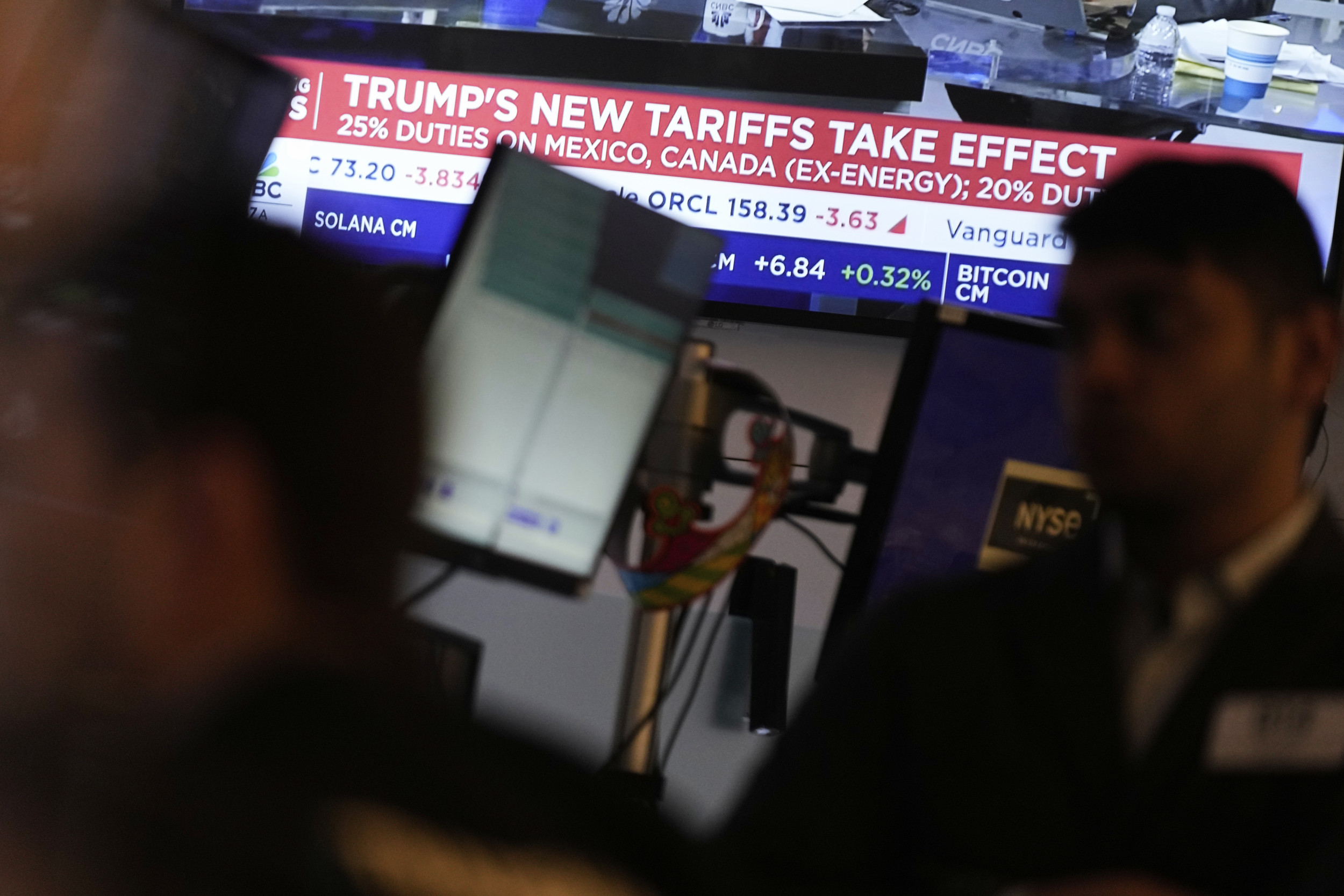

Wall Street plunged amid escalating uncertainty from President Trump regarding tariffs on Canada and Mexico, with the Dow down 0.99% and the S&P 500 sliding 1.78%. The Nasdaq Composite fell 2.61%, officially entering correction territory, 10% off its peak. CNBC's Jim Cramer criticized the lack of clarity from the White House, suggesting it creates pervasive negativity in the economy. Investors are anxious ahead of key job market data, as economists forecast 170,000 job gains for February. The ongoing trade policy volatility is raising fears of inflation and potential long-term damage to the economy.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

- The stock market is experiencing significant volatility primarily driven by uncertainties around U.S. trade policies and tariffs, with major indexes like the S&P 500 and Nasdaq seeing sharp declines, particularly as the Nasdaq has officially entered correction territory.

Articles (7)

Center (6)

FAQ

The stock market plunge was triggered by President Trump's decision to impose tariffs on Canada, Mexico, and China, leading to investor panic and global economic fears.

The sectors most affected by the tariffs include the automobile, retail, and technology industries, as they are heavily reliant on international trade.

Global markets have reacted negatively, with significant declines in indices such as China's Shanghai Composite, Germany's DAX, and France's CAC 40, reflecting widespread economic uncertainty.

The potential long-term implications include higher consumer prices, disrupted supply chains, and slower global economic growth, which could lead to a prolonged economic slowdown.

History

- 4M

4 articles

4 articles