Tech Giants Navigate Market Turbulence While Investing in AI

Meta, Tencent, and Samsung adjust strategies amid market volatility, focusing on AI investments and stock opportunities, per JPMorgan's insights.

Overview

As Meta platforms commits $60-$65 billion to AI in 2025 to boost ad performance, investors are encouraged to consider its stock amid market volatility. JPMorgan suggests buying shares of Meta and Netflix following a recent tech sell-off that pushed the S&P 500 and Nasdaq into correction territory. Tencent reported a strong Q4 with profits surpassing estimates, fueled by gaming and advertising. Conversely, Samsung faces shareholder scrutiny over AI semiconductor performance. Analyst Doug Anmuth underscores Meta's AI initiatives like Llama 4, while highlighting Spotify’s growth potential amidst wider market challenges.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

- Nvidia's recent introductions of the DGX Spark and DGX Station, designed for AI-native applications, highlight a strategic evolution in computing tailored specifically for AI developers.

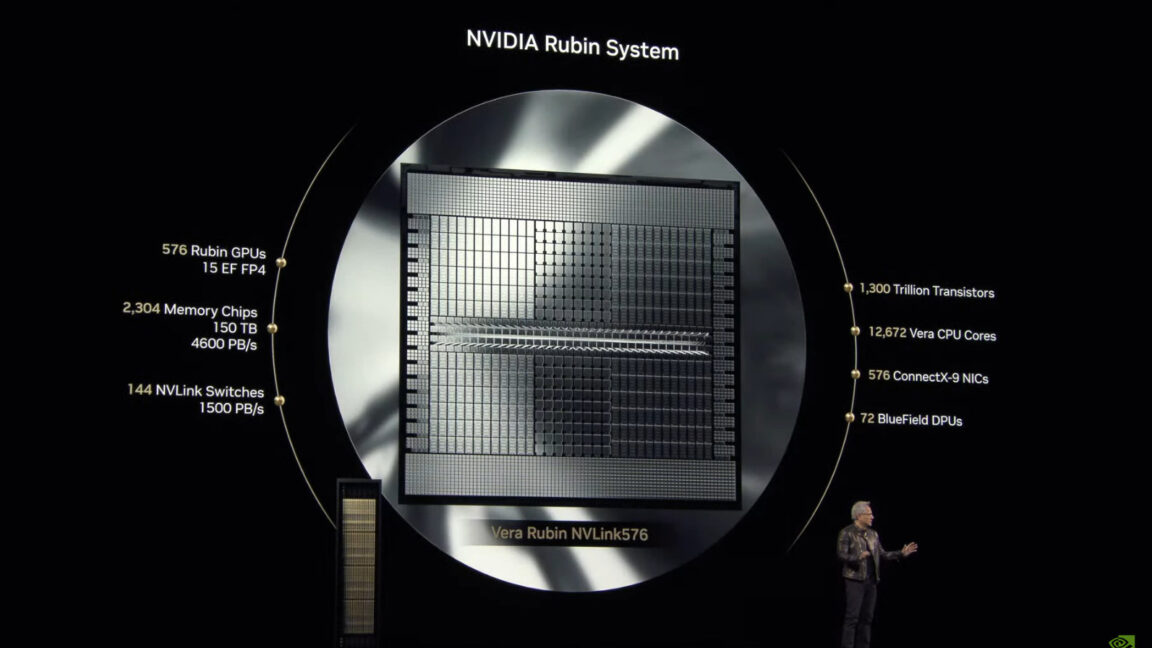

- The unveiling of next-generation GPUs, including Vera Rubin and Blackwell Ultra, signifies Nvidia's commitment to supporting advanced AI applications and improving processing capabilities for complex tasks.

- Nvidia's partnerships, such as with General Motors for autonomous vehicle development and Yum Brands for AI in restaurant operations, reflect a growing trend of AI integration across various industries.

Articles (24)

Center (23)

FAQ

Meta's AI investment aims to boost ad performance, which could enhance its stock attractiveness despite market volatility. JPMorgan suggests buying Meta shares following recent tech sell-offs.

Tencent's strong Q4 performance, driven by gaming and advertising, has likely strengthened its market position, especially in a period of tech sector volatility.

Samsung is facing shareholder scrutiny over its AI semiconductor performance, indicating concerns about its ability to meet expectations in this critical area.

History

- 3M

3 articles

3 articles

- 3M

2 articles

2 articles

- 3M

4 articles

4 articles

- 3M

3 articles

3 articles