Senate Republicans Face Legislative Clash Over Medicaid Cuts and Tax Bill Amid House Approval of New Act

Senate Republicans propose Medicaid cuts and tax reforms, while the House advances the One Big Beautiful Bill Act, complicating negotiations and budget impacts.

Ron Johnson ramps up Trump tax bill opposition with deficit report

Washington Examiner

Senate Finance Committee unveils budget bill changes

World News Group

Trump Has the Only Vote That Matters on the Big Beautiful Bill

New York Magazine

How the Senate GOP tax plan differs from the House bill

Washington Examiner

Senate GOP megabill would defund Planned Parenthood

Washington Examiner

Senate GOP releases tax plan with smaller child tax credit boost

Washington Examiner

Senate GOP to impose tougher curbs on states inflating Medicaid payments

Washington Examiner

Overview

- Senate Republicans propose deeper Medicaid cuts and new work requirements for parents, aiming to save $625 billion over the next decade.

- The Senate tax bill includes a permanent $10,000 cap on state and local tax deductions, differing from the House's proposed $40,000 cap.

- Senator Ron Johnson raises concerns about the deficit impact of the tax bill, potentially delaying the vote amid internal GOP resistance.

- The Senate Finance Committee's revisions to the tax bill may lead to millions losing health insurance, as the CBO estimates significant budget deficits.

- The House advanced and approved the One Big Beautiful Bill Act in May, complicating negotiations with the Senate's conflicting tax and health care proposals.

Content generated by AI—learn more or report issue.

Get both sides in 5 minutes with our daily newsletter.

Analysis

The 'One Big Beautiful Bill Act' is President Donald Trump’s signature agenda item in Congress.

It will affect the daily lives of tens of millions of Americans.

The Senate gives a slightly longer phase-out for green energy funds compared to the House.

Center-leaning sources frame the legislative process as a significant yet contentious development, highlighting the challenges posed by proposed changes. The authors exhibit a critical perspective, emphasizing potential difficulties for individuals affected by the bill, suggesting a bias towards advocating for more equitable solutions in student loan policies.

Right-leaning sources frame the narrative with a focus on legislative success and urgency, emphasizing the need for improvement in proposed bills. Their perspective often highlights a sense of optimism and responsibility, suggesting that lawmakers must act decisively to benefit American families, reflecting a bias towards conservative values and priorities.

The Fraternal Order of Police formally endorsed the bill earlier this month, championing no tax on overtime.

The National Restaurant Association celebrated aspects of the bill.

Articles (47)

"…It’s possible Republicans could still screw this up, but there’s really less than meets the eye in all the smoke being blown in GOP circles over the state of play on this bill."

"…Republicans are determined to pass a version of the bill, but increasingly my sources are saying the question is “not if, but when.”"

"…It’s crunch time in Congress as Republican Senate leaders try to shape the president’s so-called “big beautiful bill” into a compromise that can pass."

"…The Senate draft also enhances Trump’s proposed new tax break for seniors, with a bigger $6,000 deduction for low- to moderate-income senior households earning no more than $75,000 a year for singles, $150,000 for couples."

"…The legislation will deepen a lending crisis in which millions of borrowers are already struggling to pay off the debt from their education."

"…The proposed cuts in the Senate bill are not final, and may not end up in the version that reaches President Donald Trump’s desk."

"…The Senate proposal includes language friendly to the geothermal, nuclear and hydropower industries."

"…Senate Republicans have unveiled their version of President Donald Trump's big tax bill, but passing it will be easier said than done due to deepening fractures within the party."

"…If the prices spike in the way analysts expect, the buyers are going to be angry and looking for somebody to blame."

"…The moves are largely in line with GOP priorities to kneecap wind and solar while preserving nuclear and geothermal."

"…The new CBO analysis is in line with projections from the Penn Wharton Budget Model and the Yale Budget Lab, both of which found that the bill would add more to the deficit once the economic effects are included."

"…Some of the changes are expected to diminish the bill’s chances of passage when it's sent back to the House with the revisions."

"…The GOP tax package would create a new deduction of up to $25,000 for qualified tips received by an individual who works in a role that customarily and."

"…The Senate draft also enhances Trump’s proposed new tax break for seniors, with a bigger $6,000 deduction for low- to moderate-income senior households earning no more than $75,000 a year for singles, $150,000 for couples."

"…Senate Republicans are steadily moving along in their quest to advance President Donald Trump’s "big, beautiful bill," but some remain dissatisfied with one of the most crucial portions of the package."

"…Let’s not destroy the very schools that teach integrity, character, and Christ-like service."

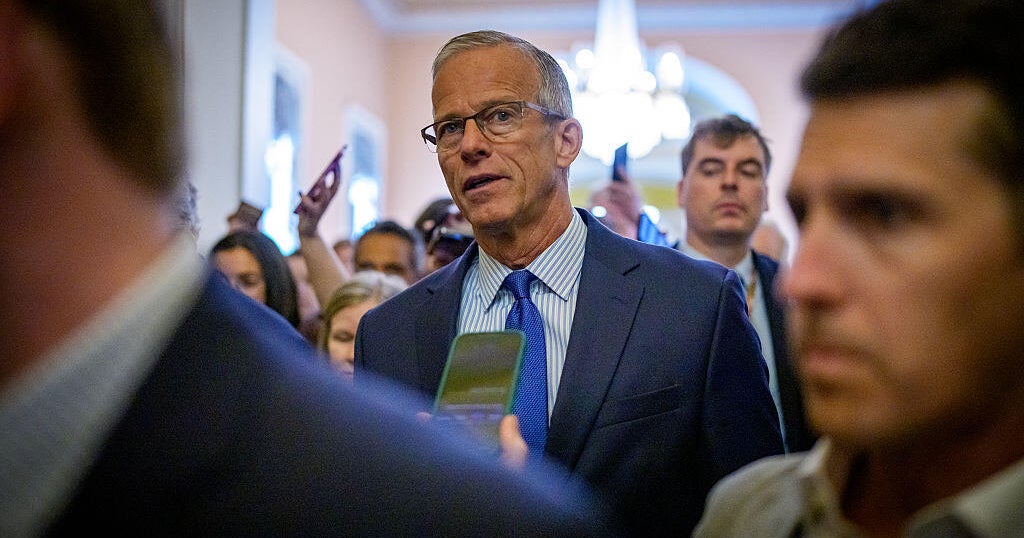

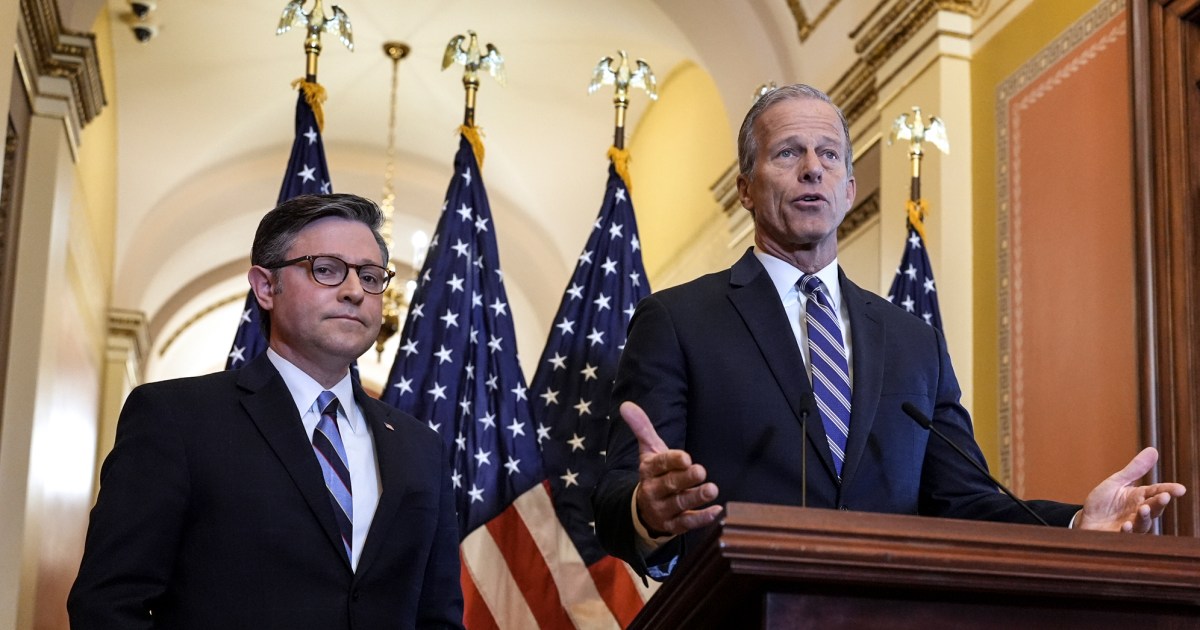

"…Johnson’s report is an implicit rebuke of GOP leadership as Senate Majority Leader John Thune (R-SD) insists the Congressional Budget Office is wrong for projecting an additional $2.8 trillion in deficits due to the megabill."

"…Support from Republican lawmakers is already beginning to slip."

"…Vance said he was "gratified and optimistic" by what he heard from GOP senators who are racing to resolve major policy disputes over Medicaid and tax incentives after the Senate Finance Committee released proposed changes Monday night."

"…Senate Republicans remain divided on three key issues: Medicaid, the state-and-local-tax deduction (SALT) cap, and green credits."

"…We cannot squander this opportunity in the Senate to help Trump deliver for American families."

"…Johnson has repeatedly qualified his opposition to Trump’s landmark bill by stating that he wants the president to succeed and is supportive of many of the budget package’s provisions, but the Wisconsin Republican says he cannot stomach a multi-trillion increase to the national debt."

"…Roy said he and his House Freedom Caucus (HFC) colleagues have been engaged in frequent conversations with the Senate about the upper chamber’s proposed changes and argued the Senate’s draft bill will not pass muster in the House."

"…Johnson’s counterproposal to the big, beautiful bill is rather simple—reduce spending."

"…The coming days will be a great test of both Senate Majority Leader John Thune, R-S.D., and Speaker of the House Mike Johnson, R-La., as they attempt to wrangle their tight majorities in both chambers."

FAQ

The Senate bill proposes a reduction in provider taxes from 6% to 3.5%, which affects how states fund Medicaid. This is a more significant change than the House bill. Additionally, the Senate version includes stricter work requirements and removes coverage for many legal immigrants.

The proposed cuts would reduce federal Medicaid spending by approximately $793 billion over ten years, according to the Congressional Budget Office.

The proposed cuts could lead to financial strain on local hospitals, which have historically relied on Medicaid funding. This could result in reduced services or even hospital closures.

History

- 6d

45 articles

45 articles

- 7d

42 articles

42 articles

- 7d

38 articles

38 articles

- 7d

33 articles

33 articles

- 8d

26 articles

26 articles

- 8d

22 articles

22 articles